Here to help to hit your passive income goals and explain exactly how this sports star became a successful investor is NRL champion (and TPC Listener!), Tom Symonds!

Yep. Tom Symonds is a 10-year professional footy player (Roosters, anyone!?!) and, although retired from the game, Tom’s currently the Players Operations Manager with Rugby League Players Association. From 2009-2012, Tom played for the Sydney Roosters; from 2013-2016 for Manly Sea Eagles and from 2016-2018 for Huddersfield Giants!!

In other words – Tom is a Pro Athlete turned Pro Investor!!!

… And he has TWO Big Tips he wants to share with you that’ll seriously move the dial on how you create a passive income for life!!

This episode is an absolute “MUST” if you’re in the sporting world… BUT it’s not just for our sporting folks…

… Tom has some great insights into goal-setting (yep!), how to take your ego our of property investing AND – the delayed gratification piece – how to navigate the temptation of “Spend it all now” versus “Save some for later”!!

Plus, there’s something about “The Wage Myth” and professional athletes that might need clearing up too…

Tune in now to hear how this Sports Star became a SUCCESSFUL Investor (and the ups and downs along the way!)…

Free Stuff Mentioned…

- Free Report: 10 Tips Every Landlord Needs To Know To Protect Their Property

- Episode 254 | NRL Star Unpacks His Money and Property Story – Chat with Matt Srama

- Episode 270 | How To Recover When You’ve Lost Everything – Chat with NRL Star Matt Srama and Jaemin Frazer

- Episode 135 | Andrew Bogut – Why is this NBA Superstar Still Adamant on Investing in Property?

- Episode 328 | The #1 Checklist For Landlord Insurance – Chat with Greg Rowe

- FREE BOOK – The Armchair Guide to Property Investing

And of course, if you own an investment property in VIC, don’t forget to…

- Register For PICA Webinar with Leah Calnan – New Victoria Tenancy Law Update! (Monday 22nd March)

- Become a PICA Member – $5 For A Year or $20 for 5 Years

Here’s some of the stuff we cover…

- 03:32 – 130 New Victoria Tenancy Law Update!

- 05:50 – Why you should talk about your own mistakes first…

- 08:38 – How do you get your kids to listen to you!?!

- 10:34 – The FOMO.

- 11:01 – Meet Tom Symonds

- 12:16 – The money backstory…

- 13:30 – Money messages from parents!

- 14:32 – Where did his love for property come from?

- 16:57 – Can you fast track delayed gratification?

- 17:54 – Trial and Error with property!

- 19:16 – When you’re priced out of capital cities…

- 20:39 – The Buyer Decision Quadrantv – what are people compromising on?

- 23:11 – What was he earning when he first started?

- 23:24 – What are the incomes of NRL players and The Wage Myth…

- 24:54 – The property story!

- 26:45 – The property “presentations” in sports clubs…

- 29:10 – How did he course-correct property mistakes?

- 32:46 – Remember this if you are seeking professional advice…

- 35:30 – Tom’s TOP TWO TIPS!

- 39:28 – Little-know insights about Exiting the game

- 40:39 – What would Tom do differently in his property journey?

- 41:52 – The importance of influencers and mentors in your life…

- 43:02 – What do the next 5 – 10 years look like for Tom?

- 44:28 – Goal-setting hacks!!

- 46:30 – How important is PLANNING in your property investment process?

- 50:41 – The Three Key Takeaways from the episode!

- 51:50 – Did you know this about travel pillows!?!

- 52:58 – What’s Making Property News?

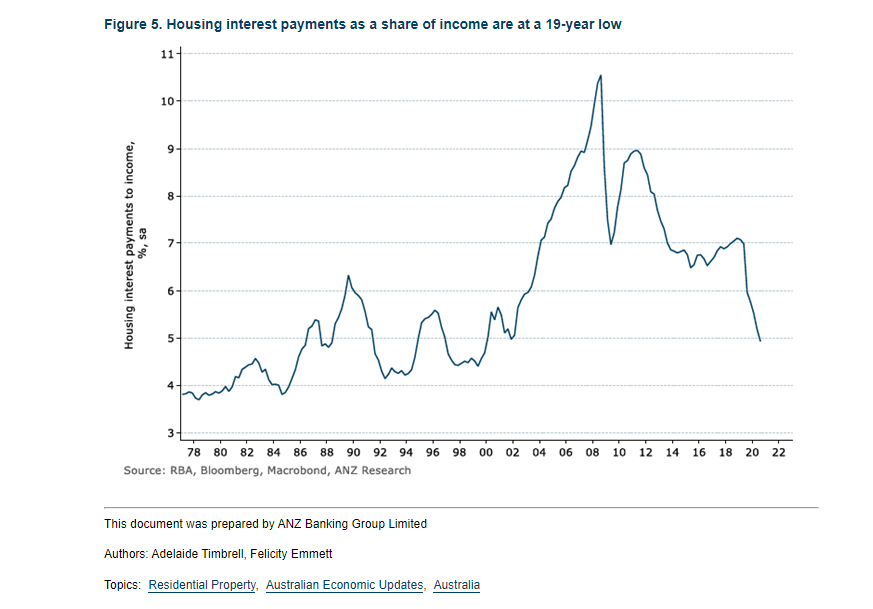

- 53:26 – How is the current property market in comparison to the peak of 2017?

- 55:13 – What does the RBA think about the rise in property prices?

- 56:38 – How long with this market cycle last?

- 57:27 – CoreLogic’s Home Value Index Results!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android

A Quick update on the Pandemic Story

A Quick update on the Pandemic Story