We all know money is simple, but behaviour is hard.

So what can we do to create lasting financial habits and behaviours instead of falling back into old money habits?

Folks, in today’s episode, we’re sharing a scientifically backed solution that’ll reveal how to achieve your goals financially and in life.

From introducing feedback loops to creating accountability (and that’s just the tip of the iceberg), we’re uncovering how these can be used to boost goal achievement, motivation, self-efficacy, and more!

It’s a revolutionary episode where we dive beyond the waters of investing psychology and into the deeper, murkier waters of why humans act the way we do. Give it a listen now!

Free Stuff Mentioned

- It’s our 9th Birthday! Our Present to You: Free Suburb Report

Time’s running out to get your Suburb Report for free. Learn how your suburb has performed and its changing community and properties. - “Make Money Smart Again” Book: Our MoneySMARTS money management that’ll reduce your decision fatigue, teach healthy financial habits, and (as the name suggests) simplify your money management. 😊

- “The Armchair Guide to Property Investing” Book: The simple steps to invest in property and how to achieve your passive income goals.

- Moorr Money Management App: Our platform automates the money management system from “Make Money Simple Again” (available on mobile and desktop). We’ve just introduced MyFinancials and Historical Tracking to help you easily track your progress towards your financial goals!

- Read James Clear, Author of Atomic Habits, Ultimate Habit Tracker Guide

- Episodes 261 | How to Hack Your Habits to Make You a Better Money Manager – Chat with James Clear

Events Mentioned

- The Property Investors Council of Australia (PICA) Webinar:

Melinda Jennison, REBAA Chair, will share insights into the 2024 market outlook, key elements to watch out for as property investors and uncover what buyers’ agents bring to the table. 7-8pm, 27th February AEDST. - Investing for Doctors: Financial Independence Career Optionality Conference

Ben will be the first speaker on Saturday, 9 March! Tune in to hear a range of speakers from the property world sharing information to assist doctors in everything they need to succeed in their financial and wealth creation journey. The event runs 9-10th March in Sydney.

Timestamps

- 0:00 – Why Your Financial Habits Aren’t Sticking

- 1:21 – It’s our 9th birthday & upcoming events

- 8:07 – Mindset Minute: Saving vs. Investing

- 9:39 – “Money is simple, behaviour is hard”

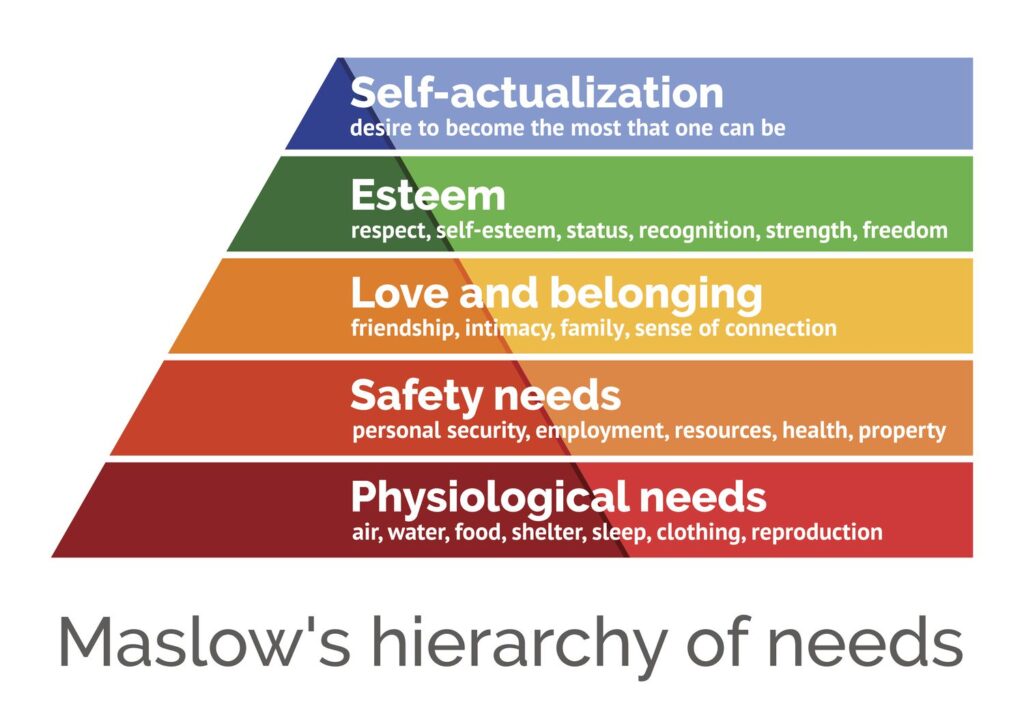

- 12:00 – The secret behind motivation and goal achievement

- 14:00 – How to implement goal tracking

- 16:32 – Why financial goals are no different from any other goals

- 20:18 – Finding evidence to increase your Self-Efficacy

- 22:21 – Be, Do, Have

- 26:02 – Habit formation and behavioural change

- 29:14 – How Ben quelled his financial anxiety

- 33:15 – C_ _p_r_s_n is the thief of joy

- 36:05 – Keep it simple!

- 40:10 – How to overcome decision fatigue

- 43:44 – THIS can be used for the power of good or bad

- 49:37 – If you see the progress, it makes you…

- 52:37 – Perception of t___ and e____

- 54:27 – This is the 2nd most important thing to be successful

- 56:21 – How to track your progress easily

- 1:06:16 – Recap

- 1:07:20 – Sustained Consistency!

And…

- 1:08:15 – Lifehack: Small action to motivation. Take action today.

- 1:22:54 – WMPN: Interest rate cuts in the later part of year…

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android