One of the greatest barriers that an investor will face when entering the property market is…

Saving for a home deposit.

With high housing values and a steadily rising cost of living, saving for that first big leap onto the property ladder can seem daunting to some and impossible to others.

Here to part the sea of confusion and simplify home deposits, we’ve got a fantastic number of guests on the couch (In fact, this is the MOST guests we’ve had on at a single time 😮)

Please welcome…

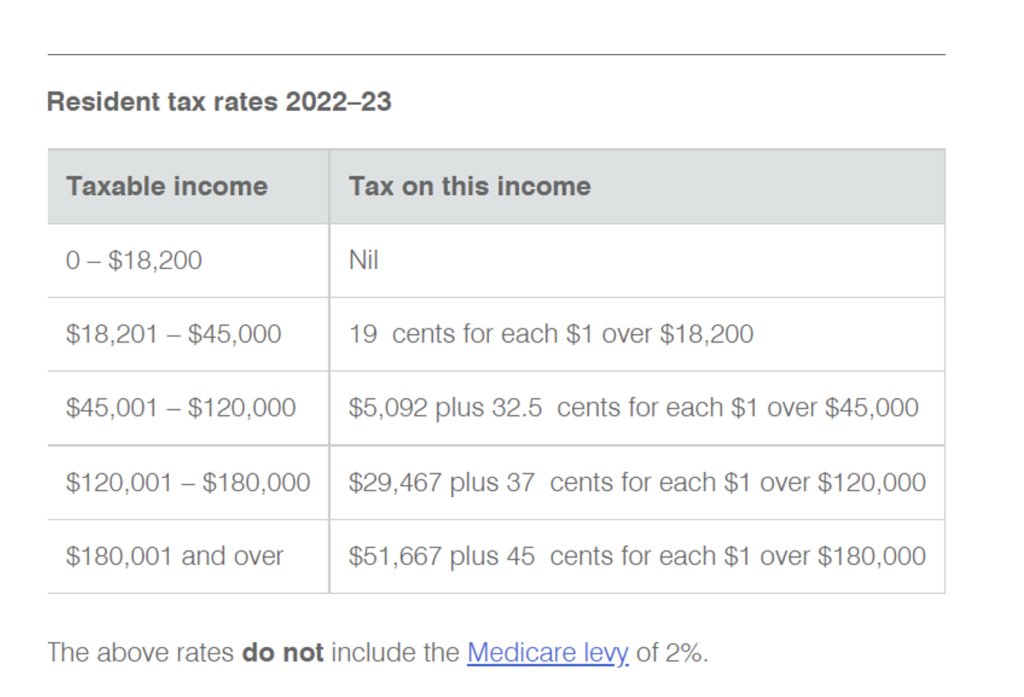

Julia Hartman, founder of the Ban Tacs group and Chief Technical Tax Advisor for Empower Wealth Tax! No stranger to the couch, she’ll be breaking down the Australian government’s latest and greatest home deposit schemes to help you understand how you can maximise the benefits from it.

Michael Ragavan from Our Leg Up, an innovative and revolutionary platform that seeks to tackle the problems around borrowing power, skyrocketing Lenders Mortgage Insurance (LMI) and Loan to Value Ratio (LVR) stopping investors from getting into the market.

And last but not least….

James Bowe from OwnHome, a mind-blowingly cool product that helps home buyers pay off their mortgages while living in their property.

Tune in as they dissect and break down the many ways people can save and afford their home deposit, and how it is possible to buy your home with just $35K!

A super exciting, insightful and practical episode, listen in now!!

P.S. We have NO commercial ties to any of these businesses – we just think the work their doing is life-changing stuff, and good enough to be shared with the community.

Free Stuff Mentioned…

- Want help with your home deposit? See how our award-winning team, Empower Wealth can help! Book a free, no-obligation consultation with our team here.

- Learn more about the Australian Gov’s First Home Guarantee (FHBG) Scheme here.

- Read Julia’s Blog Home Deposits – Made Simple: Two Years @ $200 Per Week and No LMI here.

- (Not Free) To find out more about Julia’s Super Organiser Spreadsheets click here.

- Read ABC’s article Stamp duty legislation passes NSW parliament despite opposition from Labor and Greens here (from Ben’s What’s Making Property News!)

- Check out today’s guests and their life-changing products below:

Psst – we have no commercial ties to these folks! We genuinely just think their products are downright revolutionary.- Ban Tacs: A national co-operative of professional tax accountants who specialise in tax and property.

- Our Leg Up: Focused on diminishing wealth inequality, Our Leg Up aims to help Australians to use the wealth tied up in their property as funds for investment.

- OwnHome: Provides a new path to homeownership, by allowing hard-working Australians to save for their dream home while they live in it.

- Listen to Episode 411 | Meet the NSW Premier: Reforms, Housing Affordability & Cutting Red Tape – Chat with Dominic Perrottet

- For more gold from Julia Hartman, check out her other episodes:

Want to work with Bryce & Ben’s Award-Winning Team?

- a roadmap to $2k per week passive income? >> Start a conversation with our Qualified Property Investment Advisors…

- buying an investment-grade property in an investment-grade suburb? >> Start a conversation with our independent and experienced Buyers Agents…

- set up or review of your borrowing strategy? >> Start a conversation with our Investment Savvy Mortgage Brokers…

- your defence implementation? >> Start a conversation with our Financial Planners…

- maximising your tax refund? >> Start a conversation with our Investment Savvy Tax Accountants…

Here’s some of the gold we cover…

- 0:00 – Here’s what we’re covering today…

- 3:59 – Is FOMU stopping you??

- 9:59 – Welcome back Julia from Ban Tacs!

- 11:53 – THIS is why Julia wrote the blog!

- 13:11 – Is it possible to buy a home with $35K?!

- 14:35 – What is the First Home Buyers Guarantee (FHGB)?

- 15:37 – Here’s how it works… (You can read the blog here!)

- 19:09 – This is basically what you’re deciding…

- 20:43 – Who would benefit MOST from this?? (+ who qualifies!)

- 22:20 – But what if I want that money back from my Super??

- 25:17 – What does this look like...as a Sole Parent?

- 26:26 – You have to pass these 2 tests!

- 28:36 – As a Couple with Children

- 30:55 – As a Couple with no Children

- 35:01 – And, as a Single Person with no Children!

- 40:05 – South Australia: “It’s a brain drain for the other states!”

- 43:42 – Meet Michael from Our Leg Up! (& what problems they’re trying to tackle!)

- 45:28 – How does “Our Leg Up” work?

- 47:25 – Rising LVR and LMI: What’s considered a good rate today?

- 48:59 – Let’s break it down: What’s a Charge (aka. Equity investment)?!

- 50:50 – “It’s lazy equity”

- 52:49 – How does this help first-home buyers??

- 53:55 – The process of developing Our Leg Up + what’s next!

- 55:01 – …and this is why it’s a Win-Win situation!

- 58:01 – If you’re interested, here’s how you can learn more!

- 58:40 – What criteria does Our Leg Up look for?

- 1:01:55 – Meet James from OwnHome + the challenges their tackling…

- 1:03:49 – This is how the idea was born!

- 1:04:48 – How this 4-step journey works!

- 1:07:02 – “You share the capital growth”

- 1:08:24 – Who are they trying to help?

- 1:11:32 – How does OwnHome make money?

- 1:13:47 – Why is there a time expiration?

- 1:14:46 – Paying LMI, Capital Gains Tax & Stamp Duty!

- 1:20:28 – How do they get their Capital Reserve?

- 1:21:39 – Limitations and future plans for this business!

And…

- 1:24:54 – Julia’s Special Appearance Life Hack: CGT Record Keeping & the best way to do it!

- 1:29:56 – NSW’s (great) Stamp duty legislation change!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android