Folks…we’re going to be honest with you.

This episode took us 4 years (and countless emails) to land, and that’s because today’s super special guest is none other than the famous…

CHRIS VOSS, former FBI hostage negotiator and author of the book Never Split the Difference!

He has had a jaw-dropping, movie-worthy career working for the Federal Bureau of Investigation (FBI) that spans 24 years. Across the time, he has worked in roles such as the Lead International Kidnapping Negotiator and Hostage Negotiation Representative for the National Security Council’s Hostage Working Group (Yep. We’re also jealous of those titles 😉)

But of course, that’s not all! In 2019, he went on to create and narrate The Art of Negotiation Masterclass and is currently the CEO of the Black Swan Group. He also works as adjunct Professor at Harvard Law School, Georgetown University’s McDonough School of Business, and as a lecturer at the Marshall School of Business at University of Southern California.

Basically, Chris has had a lifetime of experience in resolving crises and high-stake negotiations and today, we get to sit down with this inspiration and discover how to use his knowledge to win the property game.

From the #3 tactics Chris uses to gain the upper hand in negotiations to the 3 extremely different and crucial Yes commitments, we’re digging into Chris’s fascinating brain to understand exactly what Tactical Empathy is and why you should NEVER split the difference.

It’s an episode that’s been 4 years in the making and we promise you – it’s one that’ll completely enthral you. Give it a listen now folks!

P.S. Be sure to stick around ‘til the end to hear the two golden tactics that’ll make you, as a buyer, the one they want to sell to!

Give it a listen now or watch the Episode below!

Free Stuff Mentioned…

- Read the article from Ben’s “What’s Making Property News” here.

- Curious about Never Split the Difference? Watch these videos to get an idea of the gold this book offers:

- (NOT FREE) Join Chris’ global group coaching sessions on Fireside! Deep dive into one topic every month with the Black Swan’s best coaches. Find out more here.

Here’s some of the gold we cover…

- 00:00 – CHRIS VOSS: FBI Hostage Negotiation Masterclass on Why You Should Never Split the Difference

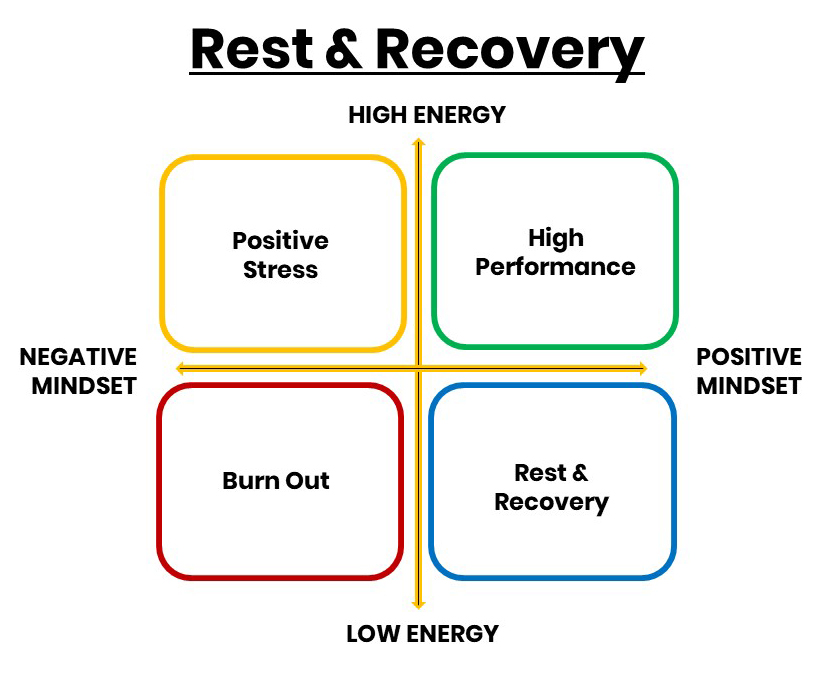

- 3:18 – Mindset Minute: People default to whatever society tells them…

- 8:11 – We’ve been chasing this interview for 4 years?!?!

- 10:48 – Leading by example & learning money habits in college

- 14:06 – Kidnapping in Haiti…

- 17:05 – What’s more stressful??

- 18:16 – When you put predictably in the process… 😮

- 19:47 – Putting certainty into the conversation

- 21:23 – “No plan ever survives the first encounter with the battlefield”

- 22:08 – The Accusations Order

- 24:26 – Listen to someone who….

- 27:46 – Sympathy vs. Empathy

- 28:18 – Tactical Empathy – it’s all about the packaging😉

- 30:50 – The Lizard Brain: These levels actually change in your brain…

- 32:59 – Use this 1 line to get people to open up!

- 34:17 – Never Split the Difference

- 37:26 – The Tactics & Question Chris Uses to Gain the Upper Hand

- 38:52 – Hearing “That’s Right” vs. Saying “That’s Right”!!!

- 40:44 – Why is “That’s Right” better than “Yes”?

- 42:51 – Manhattan Bank: The very first hostage negotiation he ever did!

- 46:38 – The Dark Side of Empathy

- 47:31 – What a win-win solution looks like

- 49:11 – Tone: They either fought, ran or flew

- 52:43 – Calm is Contagious (Here’s why)

- 53:44 – Like father, like son: Learning by watching

- 55:52 – How to use tactical empathy when buying properties

- 57:37 – Mirroring & Labelling: Why it increases your chances!

- 59:58 – Why Chris does what he does…

- 1:01:20 – The Black Swan Method

- 1:02:38 – Join Chris’s global group coaching sessions! Find out more about Fireside now.

And…

- 1:05:47 – Wow! Thank you Chris – what an amazing episode!

- 1:12:05 – Lifehack: How can labelling and mirroring work with your budget?

- 1:13:38 – What’s Making Property News: WARNING! There’s a taxpayer creep…

Want to work with Bryce & Ben’s Award-Winning Team?

- a roadmap to $2k per week passive income? >> Start a conversation with our Qualified Property Investment Advisors…

- buying an investment-grade property in an investment-grade suburb? >> Start a conversation with our independent and experienced Buyers Agents…

- set up or review of your borrowing strategy? >> Start a conversation with our Investment Savvy Mortgage Brokers…

- your defence implementation? >> Start a conversation with our Financial Planners…

- maximising your tax refund? >> Start a conversation with our Investment Savvy Tax Accountants…

Get Moorr out of your money.

Log in or create your free account via the Moorr web platform, or download the app on Apple and Android and transform the way you view and track your wealth.

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android