Over 2 ½ years ago, waaay back on Episode 66, we warned you that Winter Was Coming…

The question is folks… did you prepare?

We really hope you did. Because if you caught ABC’s three-part 7:30 Report this week or you read the OECD Housing Report that came out on Monday, then you’ll know that the Australian housing market isn’t the flavour of the month at the moment.

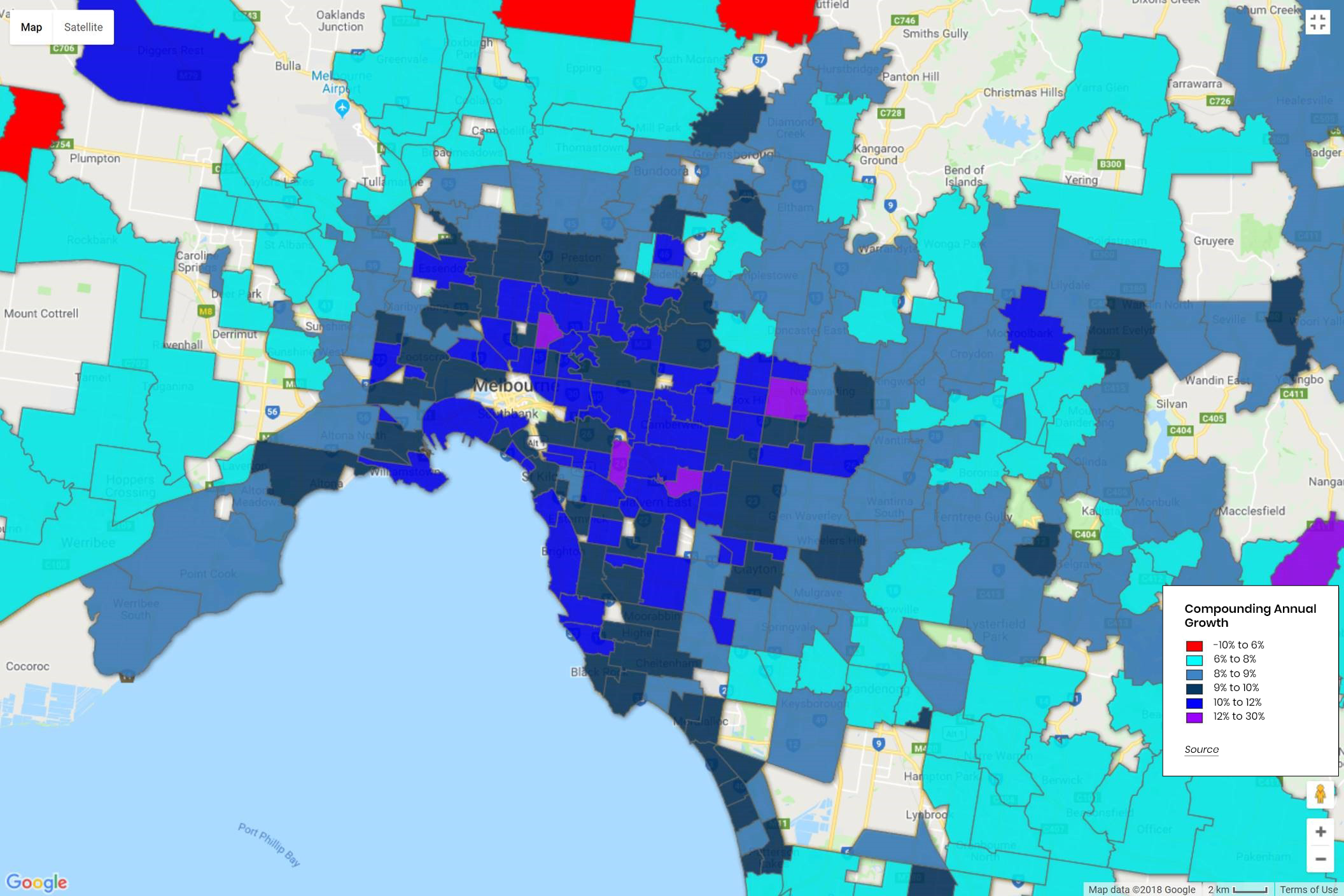

We’ve all seen that the property market come off its peak, and this, combined with the credit crunch following APRA’s lending restrictions and the Banking Royal Commission, as well as the proposed changes to Negative Gearing and Capital Gains Tax has spread a ripple right across market sentiment.

In other words, you could say… Winter is here.

So, today we’re diving into what’s unfolding with housing prices and what we’re likely to see happen in the property market from here. To help with this, we’re revisiting what we discussed 2 ½ years ago — Episode 066 | Winter is coming and the air will be colder up high.

And folks, the similarities between what we said then to what we’re seeing now just might shock you! Those who acted early and pulled out the umbrella won’t be surprised.

BUT the real question is: what does all this mean for you and the future of investing in property?

Or do you simply want a straight answer to “What the heck is going on in the property market right now?”

We’ve got you covered.

Here’s the wild ride you’re in for…

- What exactly was portrayed in these reports?

- What’s the catalyst behind the downturn?

- What property type is most affected?

- What did Ben say back in 2016 in Episode 66 in about this?

- Who will be affected now that Winter is here?

- What is the mean property price in relation to the average income?

- What did we say would like happen to sentiment two and a half years ago?

- What had we predicted about the “paper wins” of Off the Plan properties?

- Will this spread to the broader economy?

- How can you navigate the credit crunch?

- How long can we expect this to last?

- What’re the ramifications of a “building boom”?

- Will we see the “longest housing downturn?” in Australian history?

- Why is Negative Gearing NOT a good idea right now?

- What about the “R” word — Recession? Why is this a real possibility?

- What creates a technical recession?

- What’s generational wealth?

- Is The Great Australian Dream just that… a dream?

- Is it a time to be fearful or a time of opportunity?

- How can you future-proof your portfolio in a changing market?

- What will happen to The Wealth Effect?

- What does Tim Lawless have to say about the Property Market?

The REPORTS and Media mentioned…

ABC’s 7:30 Report – Latest figures from CoreLogic

And ABC’s 7:30 three-part video series…

P.S. It ALWAYS comes down to the fundamentals!!!

DOWNLOAD our Free Binge Guide Here – The First 20 Episodes

This 80-odd page document is the vault containing all the foundational tips and insights you need to be a successful investor.

Want a Free Copy of The Golden Highlights? You can get it here.

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android