Folks, it’s time to strap your seatbelts in and tighten your property investing hats because in today’s episode, we’re doing our own Back to the Future with our first-ever Throwback Thursday!! 🔮

We’re revisiting our best property investing strategies and theories from aaallll the way back in 2015 and asking…

Are they still relevant today?!?

We’ll be unpacking (Yep, that’s still a favourite word of ours today 😉):

🛠️ Ep 1. We Fix Bad Property Investment Advice: The two most common regrets we hear and our cornerstone “Barber Analogy”: Is it still applicable or has it become obsolete?!

🚀 Ep 2. Regulation vs. Education: How has income vs. Property prices changed? And what makes inner land value 3x higher than land further out?

🏠 Ep 3. The 4 Pillars of Mastery: Do we still use the same process to set investors up for success? And why is MoneySMARTS still extremely relevant today?!

To hear all of this, plus some of our favourite quotes of all time from these episodes, tune into our first Throwback Thursday now!!

Free Stuff Mentioned

- We’ve got ONE last spot on our 2024 Summer Series. Share your story with us today! >>

- Check out Binge Guide featuring the first 20 episodes here >>

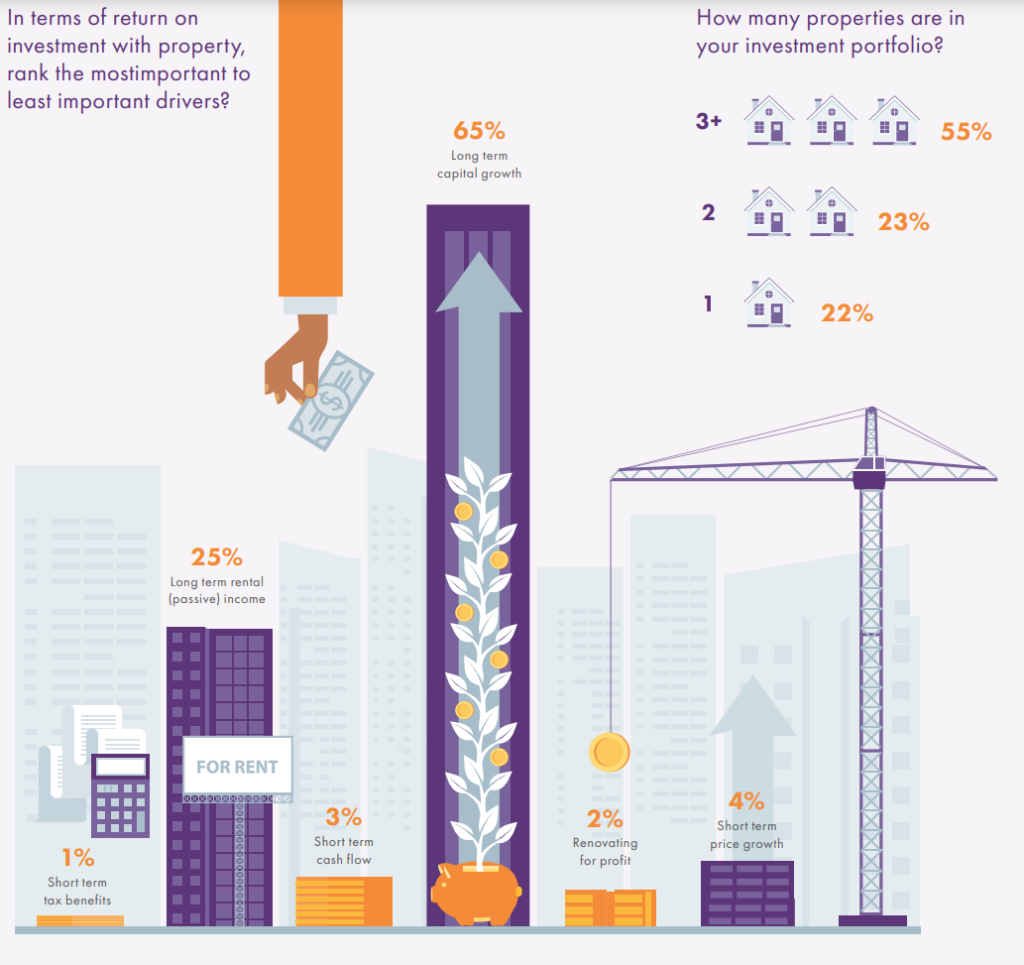

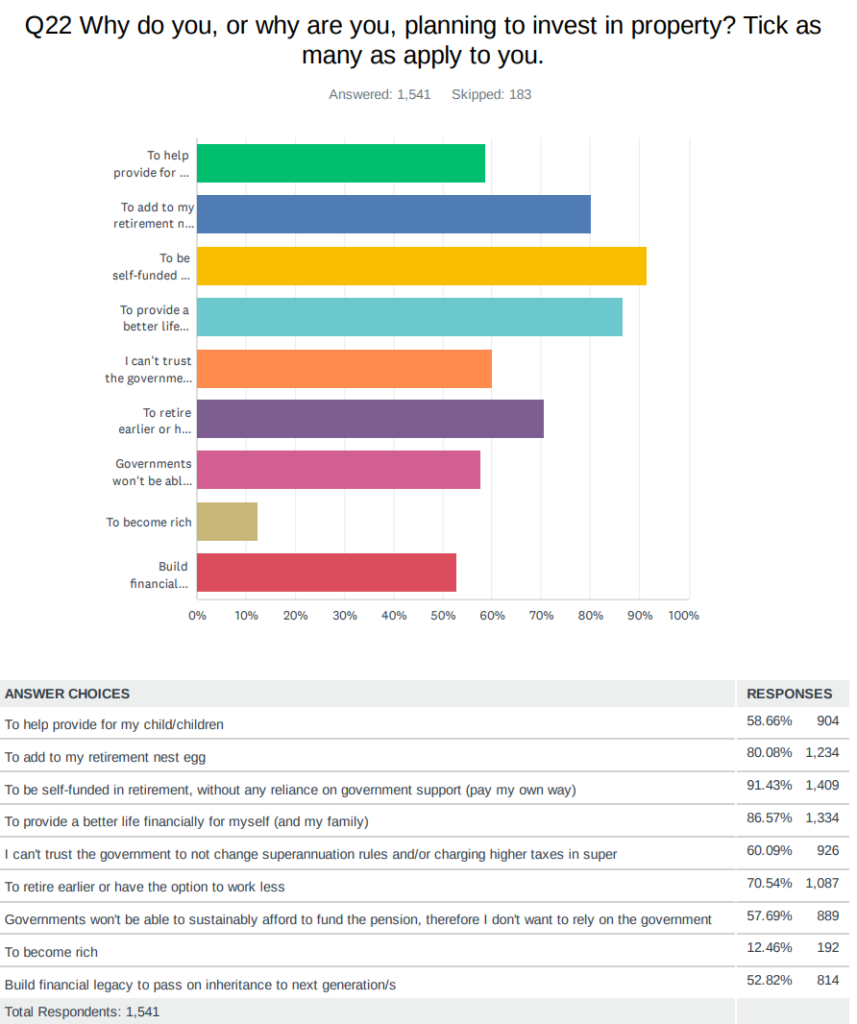

- See the graphs from Ben’s What’s Making Property News! Below:

Timestamps

- 0:00 – Back To The Future: Are Our 2015 Investing Strategies Still Relevant Today?

- 2:15 – We’ve got one spot left on our Summer Series!

- 3:03 – Mindset Minute: Where the pursuit of Mastery lives…

- 7:26 – It’s Throwback Thursday!

- 8:55 – Ep 1. We Fix Bad Property Investment Advice

- 9:26 – 💈 The Barbershop Analogy 💈

- 15:29 – The 2 most common regrets

- 16:33 – Is it still relevant today?!?

- 19:12 – The Enthusiastic Amateur

- 22:40 – “You can get everything you want in life, if you just…”

- 26:14 – Ep 2. Regulation vs. Education

- 29:09 – These fundamental rules have not changed folks…

- 35:58 – The top #3 evergreen quotes

- 36:57 – Is buying counter cyclical still a good idea?

- 38:21 – What makes this land value three times higher than other land?

- 41:36 – Income vs. Property Prices: What’s changed?

- 45:55 – We always start with THIS when building our investing strategies…

- 47:51 – Ep 3.The 4 Pillars of Mastery

- 48:56 – How we set up investors for success

- 52:12 – Debt Servicing Debt: Did this theory work?

- 54:19 – This is what drove MoneySMARTS…

- 58:47 – Our favourite quotes

- 59:42 – A moment for Ben 🤗

- 1:02:32 – Check out our free Binge Guide! >>

- 1:03:09 – Here’s to the Stig ❤️

And…

- 1:04:32 – Lifehack: Table tennis on the dinner table?!

- 1:07:27 – WMPN: Why People Invest in Property!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android