Buying in a heated market is kinda like jumping off a cliff because everyone else is jumping…

…many investors start buying any old investor stock (Call it a classic case of the FOMO), but the problem is, how do you know that a heated market hasn’t already reached its peak before you even jump in?

The answer is: Sometimes to get ahead, you’ve got to take the road (or cliff) less travelled! (We might be going overboard with this analogy)

In this case, it’s using a counter-cyclical strategy.

Today we’ll be exploring what this is, the benefits it can bring, and how becoming a borderless investor could be best for you!

But remember folks: Each state has its own cycle, and it’s not always easy to tell WHERE the market currently is!

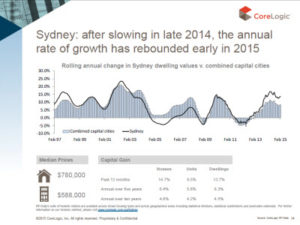

To help you determine this, we’re sharing a fantastic resource called CoreLogic Monthly Housing & Economic Chart Pack. This pack allows you to see how each state’s property market has performed over the past 30 years! (Just click on the image to download the report now!)

The message today folks is it’s all about market timing and avoiding making rash decisions. To learn how to navigate both, listen in now!

Free Stuff Mentioned:

Just starting your property investing journey? Check out our FREE Binge Guide to the Foundations of Property, Finance and Money Management, which show you which episodes you need to understand the basics! Or fill in the form below and we’ll email it to you right away.

Here’s some of the gold we cover…

- 1:00 – We’ve got something to celebrate…

- 2:30 – Sydney folks, beware the bubble!

- 3:40 – Why we’re lucky in the property market

- 4:05 – The psychology of the buyer

- 5:10 – The “Rebound” Property

- 5:59 – The biggest market cycle Sydney has seen

- 7:00 – Ben’s experience with this market cycle

- 8:05 – A quick look at Australia’s market cycles

- 9:00 – Don’t be caught up in FOMO, instead become a _____ _____!

- 9:45 – Interest rates, value and heated markets

- 10:39 – Were seeing THIS for the first time in Australia’s history!

- 11:00 – The PROBLEM with buying in a heated market

- 11:50 – What is buying counter-cyclical? (Don’t end up like this client!)

- 13:20 – The role of Government and Australian Prudential Regulation Authority (APRA) in an unregulated heated market

- 15:30 – THIS helped us through the Global Financial Crisis

- 16:00 – 1 property, 2 different investors, 2 very different results…

- 17:30 – What markets you should be looking at investing in!

- 18:07 – Why you should want ____ ____ to control the markets

- 19:09 – In summary, we love you Sydney BUT…

- 20:30 – Check out the Chart Pack!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android