As mentioned on Episode 277 (Coronavirus and Property FAQ), we know that you’ll be spending a lot of time indoors. So we want to make sure that you’ve got enough material to keep you indoors! And there’s no better time than now to reflect and upgrade yourself to the next level be it in property, finance, money management or even MINDSET! So here’s our Isolate + Chill aka Self-Isolate and Self-Develop Showbag. 🙂

Scroll down to see all the links to the playlist. If you’d like us to email it to you instead along with some additional bonus materials, then just fill the form below. 😉

Now, let’s cut to the chase! We want to get you started on your Self Isolate and Self Develop Journey as soon as possible!

For iTunes Listeners

Here are the steps to import the playlist to your iTunes on your computer:

- Click here to download the playlists files

- Open up the downloaded zip folder and extract all the files onto your desktop

- Open up your iTunes

- Go to the top left corner of iTunes and look for “File”. Then, look for “Library” and select “Import Playlist”

- A pop up will appear. Just navigate to your desktop and import your preferred playlist.

- And that’s it! Your iTunes will import only one playlist at a time so you can repeat the steps if you’d like to import more than one playlist.

- Happy Learning!

Still not sure how to do it? No worries! Stiggy got you covered. Watch the step-by-step video below:

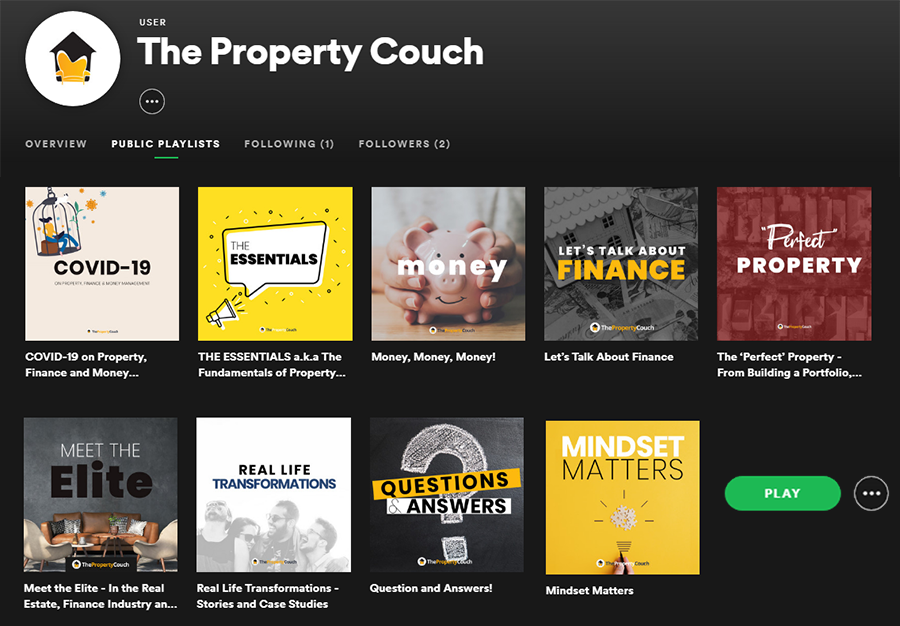

For Spotify Listeners

It’s easy for you folks! Just click here to go to our profile and start following your favorite playlist! 😊

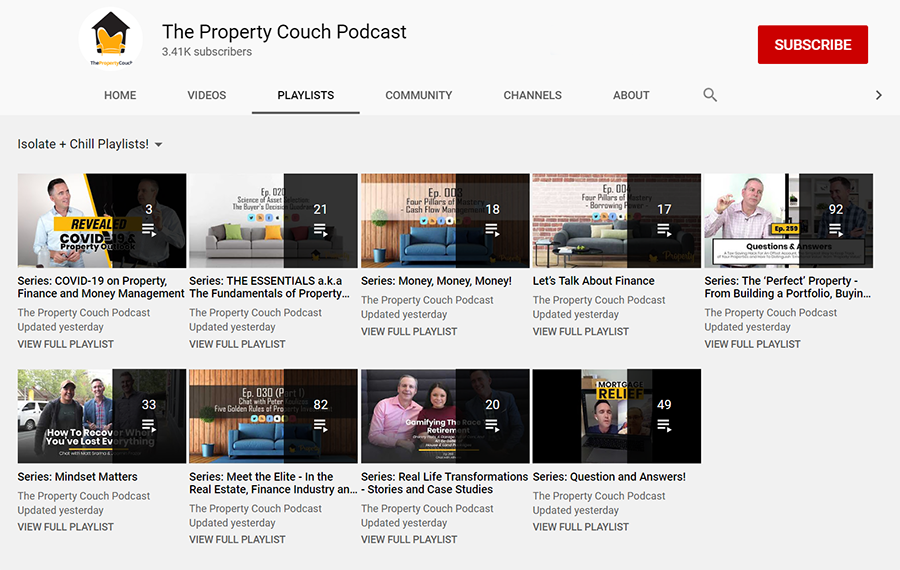

For YouTube Listeners

And of course, our YouTuber community! You guys get a couple of extra playlists too – The TPC GOLD and LIVE Videos! Just click here to go to our profile and pick your favorite one. 😊

Here Are All our Playlist Folks!

What’s Included in this Isolate + Chill Showbag?

Our top downloads, all in one email!

- Make Money Simple Again (Free eBook)

- The Binge Guide to the Foundations of Property, Finance and Money Management (Free PDF)

- Our Top 5 Frameworks for Property Investors (Free PDF)

- The Money Savings Hacks The Banks Don’t Want You To Know About (Free Video Series)

All these playlists and their links so you can re-visit them whenever you want!:

COVID-19 on Property, Finance and Money Management:

Across the globe, we’ve all been impacted by COVID-19… and it doesn’t look like it’s slowing any time soon…

With all of the unknows out there… what DO we know? And how is COVID-19 going to affect property prices, the economy and our purse strings? Get our recent updates here.

THE ESSENTIALS

The essentials are the absolute fundamentals of Property, Finance and Money Management! These are the FIRST 20 EPISODES of The Property Couch and are a must-listen for everyone. Check out the “Binge Guide” that covers all the best bits -go to “Free Resources”!

Money, Money, Money!

Money. It makes the world go round. But no one likes “too much month” at the end of the money… so check out our best episodes on Money Management – incl. Money SMARTS, Money Habits, Money Hacks and Money Mindsets

Let’s Talk About Finance

A property investor walks into a bank and says, “Hey, can I have a home loan?”

Just joking, don’t do that. Listen to these instead – from everything to Borrowing Power, Offset Accounts, Interest rates, Finance Structure and Strategy, Investment-Savvy Mortgage Broker and much, much more…

Finding The ‘Perfect’ Property

How do you find the perfect property? What does it look like and where is it located? Find out the top tips on asset selection, incl. investment stock vs investment grade, the reality of tax depreciation, property “spruikers”, contract reviews, building a portfolio and way more!

Mindset Matters

A wise man by the name of Jim Rohn once said, “Stand guard at the door of your mind”.When it comes to property, finance and money management matters. Why? You’re going against the tide. So invest in your mind as well as your knowledge… Hear from ….

Meet the Elite

They’ve Been There. They’ve Done It. And Now They Teach What They’ve Learnt. Hear from the professional experts who have made a living out of investing in property and know first-hand what to do (and what never to do)! Ft. Jan Somers, Paul Clitheroe, Effie Zahos, Susan Alberti, Alan Oster, Alan Kohler, Roger Montgomery, Margaret Lomas, Jeremy Sheppard, Peter Koulizos, Veronica Morgan and heaps more!

Real Life Transformations

Hear first-hand from your peers who have gone ahead and implemented what they’ve learnt on the podcast! Yes, these folks are real life investors who have featured on our Summer Series because they are

1.) Awesome 2.) Have an inspiring story 3.) Explain exactly how they did it.

Question and Answers!

This is the ENTIRE VAULT of our Q&A Episodes! Yep, folks ask. We answer. We cover a HUGE list of topics/questions so take a listen at what’s most useful for you! Don’t forget, you can always send in your own Question 😊

What are you waiting for? Start your Self-Isolation and Self-Discovery Journey today!

Free resources: Isolate + Chill

Fill in the form below and we'll email you all the playlist links and bonus resources right away! 😉

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android