Folks, the Australian Government has released The 2021-22 Budget!

So, in this free report you’ll find the numbers we unpacked on Episode 339 | “Man, Can Politicians Spend Money!!” – Plus Property Q&A… ‘cos let’s face it, sometimes it can be difficult to absorb all the numbers on a podcast! We’ve also included some other “top level” Budget numbers you might find useful as well.

Here’s what you can expect in this report:

- The $15.2 billion infrastructure spend!

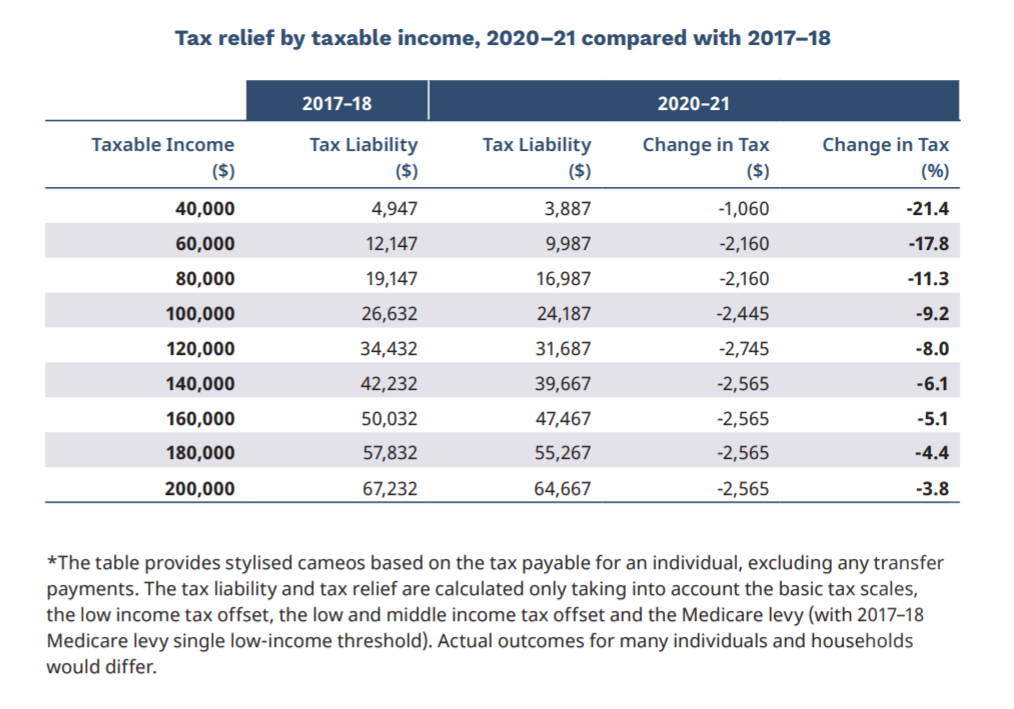

- Free cash back (Tax Offset) & how much you might be entitled to…

- First Home Saver Scheme

- Family Home Guarantee for Singe Parents

- New Home Guarantee

- Superannuation Downsizer Scheme

- The increase to the Child Care Subsidy

- Public Housing support

- The HomeBuilder extension

- VIC State Budget & the Consequences for Property Owners and Property Developers

What are you waiting for? Fill in the details below and we’ll email it to you right away. 😊

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android