“Labor risks $12bn housing hit over ending negative gearing” — if you’re like us folks… this headline has us all concerned!!

And the concern didn’t stop at the headline.

As we read on, the full news article, published by The Australian on the weekend, highlighted that the $32 billion plan to end negative gearing would — quote — lead to a fall in new housing construction of up to 42,000 dwellings over five years and 32,000 fewer jobs across the country, according to independent modelling — end quote.

Yep… that’s a drop in a whole lot of new housing construction (ie. supply) AND just a-bit-more-than-a-few losses (up to 32,000) in jobs!!

Folks… this is crazy stuff.

And those stats aren’t the only ones coming out of recent independent research digging into the numbers of what’s likely to happen if negative gearing’s ditched.

So, today we’re looking at a few of the worst-case scenarios from two different reports (the links to both of these are further down in the show notes) and unpacking — with both a short term and long term view — how this change to negative gearing might affect the property market and those investing in it.

But negative gearing changes — and the possible consequences on housing prices and for first home buyers — isn’t the only question we’re answering today! We’ve got plenty of gold on how to time your exist strategy, retiring debt and the right asset to invest in!

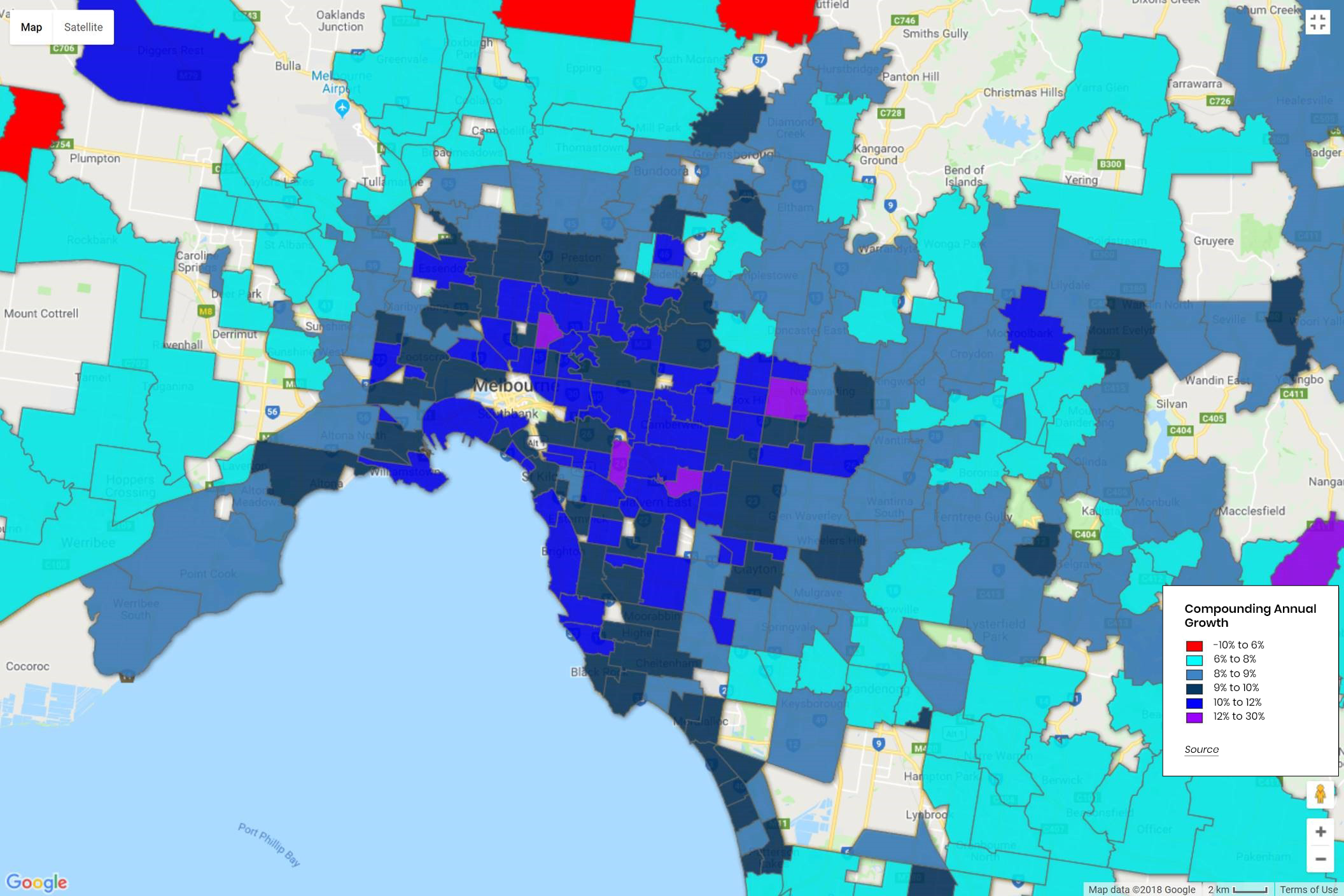

Oh, and if you’d like the Geospatial Heat Notes — the heat map that shows the Compounding Annual Growth in Median Value for Houses from 1974 till the end of 2017 that is sourced from the Valuer General data — you can get them here.

Back to today’s Q’s…

Question about Negative Gearing Changes from Shadi:

Hey Bryce and Ben. Thank you for all the information and for all the podcasts you provide. Apologies in advance if this question has been answered in previous episodes. I’ve been binging myself since episode 1 a few months ago, and am not quite up to date yet. I just have a question specifically about the abolishment of negative gearing and the impact it will have on first time investors. I’ve been looking to invest since listening to your podcast, and am interested to hear how this will affect my first purchase — whether or not it will just be a short term problem that effects cash flow or if it will have a long term effect, especially when entering the market.

Question about Your Exit Strategy from Anne-Marie:

Hi guys, this is Anne-Marie in Victoria. I’m 56 and my husband is 51. I started listening to you many years ago after we had our 7 properties. Our last property was 3 years ago. There all on fixed term interest only, which makes no offset available to them. And we’ve paid off our home, which is worth 1.1 million (1 of the 7 properties). It takes us $13,000 a year to hold all the properties, we just put our tax in, which is amazing. So property has done really well for us, and the mortgage we have on all of them is about 2.5 million, with domain value being low sitting at $3.9 mill, and high $5.2 with middle there all about 4.6 million. I want to start going into doing less hours at work — I’d like to retire on a passive income in maybe 4 years’ time. How do you transition to get the passive income we’ll need for retirement without too much of a tax liability? I paid about $10K in tax this year and I really don’t want to be paying a lot of tax while I’m getting to this point. Can you give me any pointers? And I can’t have an offset account as I said. I’d like some advice on this.

Question about the Right Asset for a First Home Buyer from Carrie:

I have a question about the best type of asset you should invest in. I’m looking to buy my first property, which I’ll live in initially. I have a budget of $750K. I’ve been looking at 70s and 80s free standing villa units in small blocks of 12 – 6 in Melbourne’s east. This puts me in middle ring suburbs around 20km from the city, with a land size of 350sqm. It’s a good balance between decent landmass without being out in the sticks. Alternatively, I could by a 2bdrm apt in an older, low density block — the type with only 2 or 3 stories closer to the CBD. Are either of these good investments? And which of the two is better? Or is there anything else I should look into. Love your work guys, keep bringing out those podcasts! Thank you

The Articles Ben mentions:

The Australian Article — Labor risks $12bn housing hit over ending negative gearing

Housing Industry Association (HIA) — Media Release

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android