Folks, you’ve heard us say it before and we’ll say it again… “The State of Your Wallet affects the State of Your Mind”…

… and this isn’t just a telling quote we throw around willy-nilly… it’s very real and is, in fact, evidence-backed. The truth is this… money worries and mental health are DEEPLY entwined. If you’ve got financial stress then, chances are, you probably feel like your whole life is out of whack… and this can seriously interfere with your mood, mindset and overall health!

So today we’ve managed to rope in a very special expert who’s dedicated his professional life to mental health matters and suicide prevention — John Mendoza Director of ConNetica.

As well as shining a light on the connection between financial problems and mental health issues, John’s career has included several senior executive positions, such as the inaugural Chair of the Australian Government’s National Advisory Council on Mental Health, the CEO of the Mental Health Council of Australia and CEO of The Commonwealth Statutory Authority, the Australian Sports Drug Agency.

Folks, if you’re wondering, “Why the switch to mental health?” or “Where does property investing fit in here?” or “Why so serious?”…

We’ll be completely honest… while not related at a tactical level to property, finance and money management… this IS related at a strategic level — ‘cos

no matter if you’re building wealth, or just trying to stay afloat and living paycheck to paycheck, or drowning in debt… or anywhere else on the financial spectrum… you’re NOT immune to this reality (unless, of course, you’re a… dunno… a cucumber, or something else non-human).

Oh, and folks… another quote for you… “The Most Important Asset is The Investor Themselves” 😉

Here’s the Free Resources mentioned in today’s episode…

- Ben’s video on rats behaviour: Watch here

- Act-Belong-Commit: https://www.actbelongcommit.org.au/

- “Chats for Life” App (helps you plan a conversation about someone you care about): https://au.reachout.com/tools-and-apps/chats-for-life

Episode’s Top Teachings…

- How’d this convo come up on the Twittersphere in the first place?

- The relationship between mental health, suicide and money management

- What age is most affected by suicide? How can you prevent it?

- What’s the strongest factor that protects people in this space?

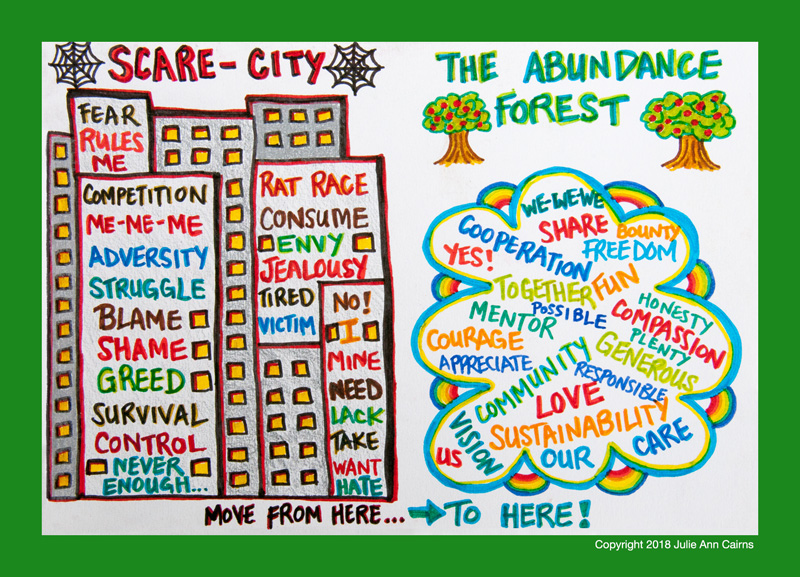

- The “B Grade Movie”… and how it’s influencing your mental health

- Who’s most at risk with mental health problems?

- What about perfectionists? (aka Bryce… back in the day)

- What’s the solution here?

- The “ABC” Steps to Good Mental Health

- What should Financial Planners and Advisors assess?

- How can you help someone who isn’t coping?

P.S. If you’re struggling with your finances or you want to be better with your money, please make sure you check our Free Money S.M.A.R.T.S Platform

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android