It’s FINALLY here! Now we know that it’s getting harder and harder to catch up to all our episodes. That is why we’ve prepared this Binge Guide to our First 20 Episodes of the podcast because these episodes are all about the foundation of property, finance and money management. In other words, it’s alright if you skip some of the podcast but not these ones! 🙂

So what are you waiting for? Fill in the form below and we’ll email it to you right away.

What to expect in this 90-pages long Cheatsheet?

What to expect in this 90-pages long Cheatsheet?

- The Foundational Knowledge in each of the First 20 Episodes

- The Absolute GOLD that you should not miss out on!

- Short snippets of quotes from Bryce and Ben that makes all the difference

- Links to all the Free Resources that they mention in those episodes

- Additional bonuses that will help you in understanding the Fundamentals more!

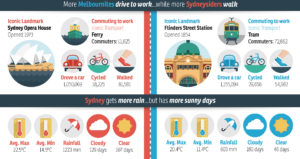

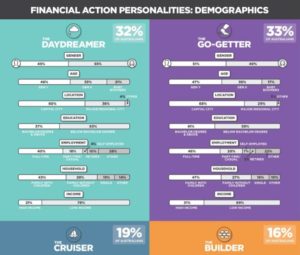

- And of course… Charts and graphs that you can’t find on the podcast!

And here’s what it looks like inside!!

Interested? Fill in the form below and we’ll email it to you right away.

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android