Get excited. Here with us is a “V.V.I.P” guest… and this very, very important person is, wait for it… the national representative of the Australian property industry… Ken Morrison, CEO of Property Council of Australia!

And he’s about to unpack the newly announced Seven Point Plan for Economic Recovery!

Yep. You’re about to become fluent in what’s exactly in store for the property market from the man who plays a significant role in shaping it – this includes everything from Government stimulus packages, accelerated growth plans, housing affordability AND a little thing called “Stamp Duty”… & why it’s probably about time this ol’ tax ended up in the dustbin!

To give you an idea of the caliber of expertise you’re about to hear from…

As the Chief Executive of the Property Council of Australia, Ken Morrison has played a key role in shaping tax, planning and infrastructure policy for our property markets across the county for over two decades. He’s super passionate about the future of our cities and sits on a range of government task forces and committees. Plus, he’s also a director of the Green Building Council of Australia, deputy chair of the Business Coalition for Tax Reform, a director of the Australian Sustainable Built Environment Council (ASBEC), and is a Property Champion of Change promoting women in leadership roles.

Key Takeaways

- A deep dive on the 7 Point Plan for Economic Recovery (and what it means for the property market)

- Ken’s backstory and what lead him to playing a significant role in the industry

- The Key Themes to Think About Beyond COVID-19

- How involved is Ken in making critical Government decisions?

- The 3 Critical Elements the Property Council of Australia is looking at right now to accelerate growth in the property market

- The Property Grants on offer across the States

- The Private Sector vs Social Housing

- Abolishing Stamp Duty – what you need to know is currently happening

- What can replace Stamp Duty?

- Negative Gearing & Capital Gains Tax

- Why is the Negative Gearing Policy STILL not off the cards?

- The Biggest Economic Downfall

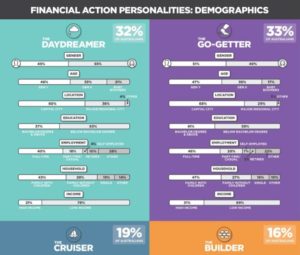

- Who is Buying Investment Properties?

- What is this idea about a “Property Rating” and home can it help homeowners?

- Change for women in leadership roles: What does it look like?

- How much does the property market influence the overall Australian economy?

- What have people been doing with their superannuation during COVID-19?!

Free Stuff

- Make Money Simple Again (Free eBook)

- The Armchair Guide To Property Investing (Free Physical Book)

- Leave us your review here for your chance to WIN our Start & Build course!

- Join PICA here

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android