APRA has recently made changes that affect a lender’s borrowing power — what does this mean for property investors and home owners… and their interest rate?

Well, folks… we’re deep diving on this today (and getting a little bit technical), because in July 2019, the Australian Prudential Regulation Authority (APRA) came out with their revisions to the “buffer” and “floor rates” of their Prudential Practice Guide APG 223.

And why are we telling you this? In a nutshell: this results in a change, potentially an increase, in a lender’s borrowing power… which means YOU can potentially borrow more money!!! (Not sure why this is a good thing? Listen to this episode on the basics of borrowing power first).

Now, if you’re wondering what on earth we mean by “buffer, “floor rates” and “potentially”… take it easy… we’ve totally got you covered here — we explain all this, incl. examples of a single person AND a couple, so you can get a “real life” angle on all this. Plus, Ben’s obviously in his element so he drops a lot of new gold and mortgage broking insights!

Oh, and did we mention that we’ve also sneaked in a little Finance Q&A as well?? Yep, true story. You can find the exact questions a little further down in these show notes 🙂

Free Resources

- RBA Cash Rate Announced — August 2019

- Not receiving our emails with exclusive offers and announcements? Become a Member of Our TPC Tribe

- Episode 004 | Four Pillars of Mastery – Borrowing Power

- Episode 043 | How to Choose a Mortgage Broker Wisely?

- Episode 55 | Investment savvy mortgage broker and why interest rate is not king?

Key Learning Points

- Debrief: How do APRA’s changes affect borrowing power?

- Why is Ben describing lending in 2020 with the world throttle?

- What is the variance in borrowing power of Principle and Interest vs. Interest Only Home Loans now? What does that mean for an investor?

- Quickstart History Guide on Lending

- What has happened to the Floor Rate?

- What is each of the “big four” bank’s NEW floor rate?

- What is a Sensitivity Margin?

- How did poor regulation contribute to the Global Financial Crisis?

- What’s a gig economy?

- How much is the Commonwealth Bank of Australia (CBA) now spending per year to rectify and enforce new changes following the Royal Commission?

- Example: A Single Person’s Borrowing Power

- Example: A Couple’s Borrowing Power

The Questions

Question from Bella

We just bought a house and are setting up our loan. Should we get our wages put directly into our offset account and then pull money into our everyday account for expenses and keep a minimum amount in there, say $2,000? My husband wants to do it the opposite way. And just pay our offset with leftovers after expenses. What should we do?! HELP!

Question from Todd

Hi Ben and Bryce, Love your podcast! Have learnt so much since I found it 6 months ago. My question is loan structure related, with tighter lending these days is it an optimal strategy to split my PPOR Loan into 3 or more splits so I can pay them off quicker and then re-borrow once payed off to invest? Or is it better to build up a large sum in my offset account? Thanks in advance guys and go Eagles Stig!

Question from James

With the RBA’s drop in interest rates to 1%, I (like most people) are considering refinancing away from my current mortgage provider. We have been looking into a few options, but keep hitting a hurdle due to being on one wage and having 2 properties (our owner occupied and one investment) as I am currently on a non-permanent workers compensation payment through DVA, the banks will not recognise my wage as a salary.

So, my question is, with APRA’s change and loosening the reigns on lending, has this already came into effect? If not, when is this due to be implemented by the banks? Thank you

Question from Stuart

Hi Bryce and Ben, long time listener, first-time caller from NZ. Love listening to all your podcasts every week. Quick question regarding my PPR and mortgage offset. I have received a windfall, which I am wondering the best use of. I could put it all into my offset account against my mortgage and with my current offset savings this would 100% offset my mortgage and I continue to pay it down over the next 10 years. Or am I better off paying down a large portion off it immediately leaving the balance fully offset to pay off over just a few years. I guess it’s a matter of keeping the offset bucket full against the mortgage, or paying down the mortgage ASAP. I also have 1 investment property, which I’ll need to reorganise to start offsetting ASAP. Hope that makes sense, thanks.

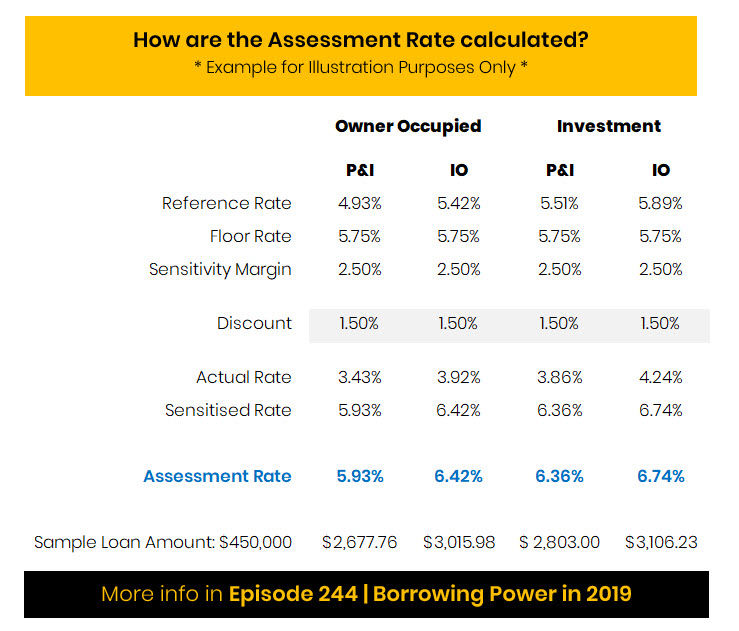

And here’s the table that Ben promised on the show! 😉

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android