This blog was originally posted on Ban Tacs and written by Julia Hartman, founder of the Ban Tacs group and Chief Technical Tax Advisor for Empower Wealth Tax.

This report is referenced in Episode 417 | Home Deposits Made Simple – Chat with Julia, Michael & James! Give it a listen now.

Combine the First Home Guarantee with the Super Saver Scheme to buy a home and nearly one-third of your deposit becomes tax savings. If you have a child, the government will provide you with mortgage insurance at no cost, so you won’t need the full 20% deposit.

The ideal candidate for this arrangement is someone who is on a good income (this means the tax incentives are greater and they can afford the repayments on 95% of the purchase price) but are struggling to get a deposit together, possibly because of high rents in the area or recent difficulties that have passed.

While this blog assumes that the saver has not ever owned a house before, some of these concessions like the government guarantee for sole parents can apply to subsequent purchases of a home. Individuals can also utilise the Super Saver Scheme, even if their partner has previously owned a home.

The First Home Owners Super Saver Scheme

This scheme allows you to withdraw some of your superannuation to buy your first home but will require you to make voluntary contributions first. The gift is, these contributions can come from before-tax dollars. If you play your cards right, this means you are only taxed at a rate of 15% on the earnings that you put aside for your home deposit.

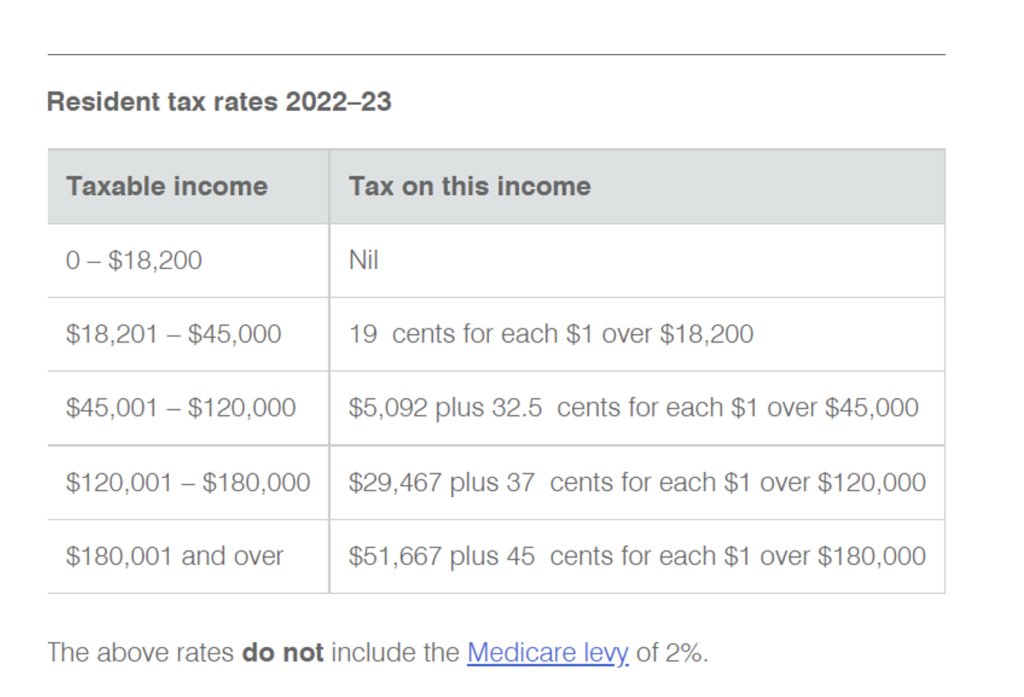

For example, if you decide you can afford to save $200 per week from your take-home pay, here are the 2022-2023 tax rates:

If you earn $140,000 a year, your marginal tax rate is 39%. That means for every $10,000 you earn you only get to take home $6,100. If instead, you put the money into super where it is only taxed at 15%, you will have $8,500 tucked away in super, saving for your deposit.

Now at $140,000, your employer will be putting $14,000 into super for you, under the guarantee. In total, you can only have $27,500 in tax-effective (concessional) contributions a year. To stay under the cap of $27,500 you could put an additional $13,500 into super to save for your home. If you have been on similar or lower wages over the past couple of years but have not made any extra superannuation contributions, then you will have over $20,000 in unused cap.

This can be carried forward for up to 5 years allowing you to contribute more than $27,500. Under this super saving plan, you are allowed to contribute $15,000 a year, after the 15% tax. That is a maximum contribution of $17,647 from your before-tax wages. This can be achieved with just a little help from your accumulated unused caps from previous years.

In short, the scheme allows you to redirect $17,647 of your before-tax wage into super, leaving you $15,000 a year towards your deposit. If instead, you had taken the $17,647 as wages you would have lost 39% in tax leaving only 10,764 or $207 per week in take-home pay. This arrangement will increase the amount you can save by nearly 50%.

Note: If you have already made some voluntary contributions to super these may also qualify to be withdrawn to buy a home.

At the end of two years, you have a $30,000 deposit, plus a bit of earnings and hopefully some savings too. Let’s say you have $35,000 to use as a deposit plus savings for the stamp duty which should be minimal on your first home.

The Technicalities:

In the tax return for the year that you withdraw your deposit from the super fund, you need to include the amount in your tax return but you get a 30% tax offset. For many people now that might mean a top-up tax of 9%. That is their tax rate is 39% including Medicare so 9% after the tax offset. But from 1st July 2024 people earning between $45,000 and $200,000 will only have a tax rate of 30% so the offset will fully cancel all the tax. This means you will need to pay the Medicare levy. If you are reading about this now then you probably won’t be ready to withdraw until after 1st July 2024.

What happens if you decide not to buy? You have at least 12 months to find a property with an automatic extension of another 12 months but if you still haven’t purchased a home and don’t want to put the money back into super you will be taxed at a further 20% on the amount.

In both cases make sure you have private health insurance if this is going to take your income as a single person with no children beyond $90,000 or a couple combining beyond $180,000.

You must apply for a release of the funds before signing a contract

Once your savings have been released, you have up to 12 months (or other period allowed) from the date you requested the release of FHSS amounts to sign a contract to purchase or construct a home.

The contract you enter into has to be for a residential premise located in Australia. It cannot be any of the following types of property:

- any premises not capable of being occupied as a residence

- a houseboat

- a motor home

- vacant land except for house and land packages.

Note: If you purchase vacant land to build a home on, it is the contract to construct your home that must be entered into to meet the FHSS scheme requirements. The contract to construct that home must be entered into within 12 months (or other period allowed) from the date you requested a release. In this situation, you must not have purchased the vacant land before applying for a FHSS determination.

How to Buy a House with $35,000

A lot depends on the price of houses in the area you want to buy in but there are also incentives for families. Here is a guide to how much you will have available to spend, without having to pay Lenders Mortgage Insurance, depending on the dynamics of your household.

It is important to note that there are two tests you need to pass with the bank and it doesn’t matter how well you do on one, you still have to pass the other.

- The first test is having enough deposit. This is achieved without mortgage insurance by either having saved 20% of the house price or qualifying for the government deposit guarantee discussed further on.

- The second test is your ability to meet the repayments, which is determined by how much you borrow in relation to how much you earn and your family dynamics. Here is a link to a useful calculator to help you calculate this.

The following addresses your family dynamics and what your $35,000 deposit will allow you to buy. You still need to run through the calculator (from the second test) above to make sure the bank will lend you that much. That is the catch with low deposit borrowings. If you only have a 5% deposit then you have to pay off a whopping 95% of the purchase price whereas a 20% deposit for the same house will result in a much smaller loan and smaller repayments because you are only paying back 80% of the purchase price.

Here is the plan based on your family dynamics; continue reading even if you are single as there is a plan for you too.

The catch is these guarantees have a limited number of places and are touted as family housing assistance, so it is assumed that having children will help. In particular, single people with children can qualify with as little as a 2% deposit. Nevertheless, let’s look at a few scenarios to show how any household dynamic can buy a house in 2 years.

Sole Parent – The government will guarantee your deposit when you have as little as 2% but you still have to be able to afford to pay off the 98%. If you have $35,000 plus stamp duty as a deposit then you can borrow $1.715 mil but, of course, you probably can’t afford the repayments on such a large loan. The point here is it’s not the deposit that will hold you back but t your ability to repay the loan. You can check your ability by using this calculator to see what the banks will lend you. If you have a good income, however, you should have no problem getting a modest home in most parts of Australia.

Couple with Children – The government will guarantee your deposit when you have as little as a 5% deposit. The “ability to repay” test should be a lot easier to pass with two incomes and with two incomes over the last 2 years you may have managed to save two lots of $35,000. But let’s say you haven’t had two incomes for the last 2 years because one parent has been at home with the children. Now they have returned to work, your savings are diminished but you have stuck with the Super Savings Scheme for the working spouse so together you have just $35,000. From a deposit point of view, this will allow you to borrow $665,000, allowing you to purchase a house for $700,000 assuming, now that you are back on 2 incomes, that you can afford the repayments on $665,000. This might not get you into inner Sydney but it should get you into most areas.

Couple with no Children – You may not qualify for the government guarantee on your deposit unless you move to South Australia – see more information below. Nevertheless, don’t give up on avoiding Lenders Mortgage Insurance!Let’s see how you can get the 20% deposit together. If you have no children then both of you can participate in the Super Savings Scheme so you will have a $70,000 deposit which will allow you to borrow $280,000 which, on two incomes you should have no problem repaying. The trouble is this only gives you $350,000 to spend on a property so possible, but very limiting. Just one extra year of saving through super will give you a $105,000 deposit allowing you to buy a property worth $525,000 which is getting much closer to the mark.

Single Person no Children – You should seriously consider moving to South Australia while you have no family commitments and taking advantage of their 3% deposit guarantee, more details below.

Otherwise, let’s look at how you could get together a full 20% deposit. With only one income, the ability to repay the loan may be an issue. Use this calculator to see what the banks will lend you. While the $35,000 from the Super Saver Scheme will certainly help, you are going to have to save another $300 per week out of your take-home pay over those 2 years, and even then you will only be able to spend around $350,000. You may need more time, a second job, perhaps move to South Australia, live a frugal lifestyle for 2 years, move back in with your parents or decentralize but it will be worth it. Two years is not that much time in your whole lifetime to get to the next level of wealth creation. It is that first house that is the hurdle, after that you have a great source of cheap borrowings for further investment.

If you do make some extra savings over and above the contributions to Super, consider living off them at the start of the third financial year of saving so that you can contribute all of your wages into super for a few months to get the tax benefits on another $15,000. The maximum is $50,000.

How the Federal Government Guarantee of Your Deposit Works

The places for this are limited and released each year so it is a step of faith to save through super with this in mind but as you can always choose to withdraw those savings from super and pay the top-up tax, it is no longer a case of “buy a home or your savings are lost until you retire.”

If you qualify for the government guarantee, the bank treats you as having a full 20% deposit for that side of the 2 tests. They don’t charge you mortgage insurance on the shortfall because the government is the mortgage insurer. Of course, you still need to repay the full amount that you are borrowing. To be clear, the government are only guaranteeing your deposit, not paying for it. So if the government offers a 15% guarantee because you only have a 5% deposit you still have to make repayments on 95% of the purchase price, which is test number 2.

This guarantee also has an income cap of $125,000 for singles and $200,000 for couples but this is as per your notice of assessment, taxable income. This means that those contributions to super will not be counted as your income for this test. A win-win!

You also need to be an Australian resident over 18 intending to live in the property. There is also a cap on how much the property can cost depending on the location – you can go to this page and put in your area’s postcode to determine the cap on specific locations.

For more information, click here.

How the State Government Guarantee of your Deposit Works in South Australia

How clever is South Australia! This is the perfect scheme to attract skilled labour to the state. To qualify for this government guarantee you have to have an education level of certificate III or higher and live in or move to South Australia.

The lender is a South Australian Government organization and they only require a 3% deposit provided you can afford to pay off a loan for the other 97%. Houses are generally cheaper in South Australia as it is.

For more information, click here.

Ultimately the message is, don’t give up. House ownership can be done!

To read the original blog on BAN TACS – National Accountants Group, click here.