Folks, as the LAST episode for 2023 before we kick off our inspiring 2023/24 Summer Series, we’re focusing on a question that looks at the heart of what we do (and not just as a podcast but through our advisory business):

What Does Money Mean to YOU!?

To properly dig into this question, we’re unpacking the psyche of the investor through one of America’s greatest psychologists and combining it with data from THOUSANDS of respondents to explore…

👉 The #2 biggest reasons that investors seek money (+ why they’re critical to our overall wellbeing)

👉 54 of the most common reasons people want to build their wealth

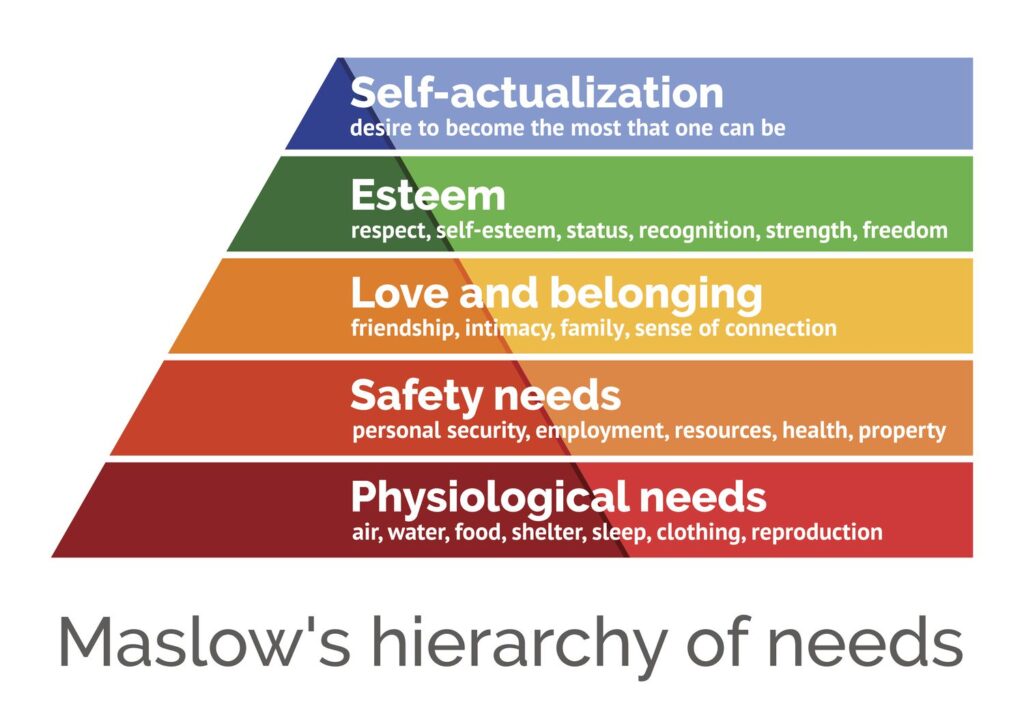

👉 How an individual’s financial freedom fits into Maslow’s Hierarchy of Needs

👉 How Time Wealth drastically improves your life

👉 The #1 thing that will ALWAYS lead to financial stress

👉 What does financial independence really look like?

👉 If you don’t know your cashflow, you risk…

Plus tons more gold! As rates and cost of living continue to rise, this super topical episode will help you remember – and solidify – your why. Listen in now!

Free Stuff Mentioned

- We’ve supercharged Moorr’s engine room! Check out the newest MyFinancial feature to help you track and manage those rising costs now >>

- See Maslow’s Hierarchy of Needs below

- Check out Victoria’s reducing rental prices from Ben’s “What’s Making Property News” Segment below (Another CLASSIC example of what happens when investors are treated like second-half citizens 🙁)

Timestamps

- 0:00 – What Money Means to YOU!

- 2:50 – We’ve added a new feature to Moorr’s financial engine room!

- 12:30 – Mindset Minute: Where are the Client’s Yachts?

- 17:03 – We use THIS planning exercise to understand success

- 20:31 – Maslow’s Hierarchy of Needs & the Top 10 Reasons We Hear!

- 26:17 – Reason 1: S_c_ _it_ – Why does it matter?

- 31:31 – Reason 2: F_ _ed_m

- 37:55 – You will ALWAYS be stressed if you do this…

- 39:18 – Safety Nets, Opportunities & Options!

- 43:24 – The complete compilation of reasons what investors want from money!

- 45:12 – A trusted advisor should actually be pulling you up on these things…

- 48:51 – If you don’t know your cash flow, how will you know…

- 50:52 – What the data reflects about the investor’s mindset

- 54:08 – THIS is the best financial asset you can have

- 56:51 – These 2 reasons ranked surprisingly low😮

- 57:29 – Bryce & Ben were surprised by these findings!

- 1:01:24 – Summer Series starts NEXT WEEK!

And…

- 1:03:18 – Lifehack: Why do some people succeed more?

- 1:07:57 – WMPN: Victoria’s rental numbers are going backwards…

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android