In this week’s episode, we’re welcoming back an incredibly passionate and eloquent data analysis and reporting expert who is ALSO a returning guest. Please welcome back…

Eliza Owen, Head of Residential Research Australia at CoreLogic!

With her experience as a housing market researcher spanning nearly a decade, Eliza has reported on many of Australia’s critical housing issues, from affordability and credit conditions to the impact of the COVID-19 pandemic on market performance.

In this episode, we’ll use her brilliant insights to explore precisely WHY we see the numbers in today’s property market, like…

🏠 With Australia facing an undersupplied housing crisis, why are some market values still falling?!

📉 How is the housing market defying economic predictions?

🔄 And what’s going on with the inverse relationship between property values and interest rates?!

Listen now to find out!

P.S. Stay tuned till the end for a sneak peek at CoreLogic’s webinar with Eliza & Effie Zahos, celebrating International Women’s Day and all the women in property. 🎉

Free Stuff Mentioned

- Our Birthday Present to You: Free Suburb Report

Learn how your suburb has performed and its changing community and properties. ‘Cos it’s our birthday month, we’re also giving it away for $0 (Usually RRP $40) - Listen to our other episode with Eliza Owen: Episode 308 | Pain & Gain: The Wealth Effect & The Housing Affordability Debate

- Read Eliza’s CoreLogic articles:

- Read PEXA’s article (Mentioned at 36:48) on Cash property purchases surge on the back of strong regional demand

- Read CoreLogic’s “Women & Property 2023” Report. (Keep your eyes peeled for the updated 2024 version: “Gender Equity in Property Ownership” report, releasing 8 March)

- Register for CoreLogic’s “The Property Ownership Insights & Financial Empowerment” Webinar held on 14 March featuring Effie Zahos and Eliza Owen.

- (Not Free) Watch the PICA Webinar replay! Become a member and watch The Property Investors Council of Australia’s recent webinar on 2024 property predictions and shed insight into Buyers Agents’ role.

Graphs mentioned

Timestamps

- 0:00 – Housing is Undersupplied, So WHY are Home Values Falling?

- 1:32 – Our 9th Birthday, can you help us + PICA Webinar Replay

- 4:09 – Mindset Minute: The Paradigm for Investors

- 9:17 – Welcome back Eliza Owen!

- 10:40 – Recap & Money Backstory

- 12:05 – Eliza has never used a credit card: Financial conversations & emotional responses to money

- 16:48 – Why she decided to buy a unit over a house!

- 21:56 – If housing is so undersupplied, why are some markets falling in value?

- 24:35 – How does changing family and renter demographics affect demand?

- 27:46 – The social problem with housing

- 30:18 – What is True Demand?

- 31:44 – If interest rates go down, will APRA’s 3% buffer rate go down

- 32:50 – How the housing market is defying economic indicators

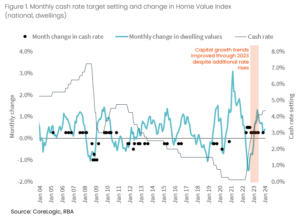

- 33:43 – The inverse relationship of property values and interest rates

- 36:48 – 25.6% of properties purchased in cash?!

- 38:22 – The masterstroke in Western Australia’s market

- 41:24 – Are we seeing green shoots?

- 44:05 – How much of what we saw in 2023 is due to behavioural economics?

- 45:31 – If rates don’t pause, will more homeowners be forced to sell?

- 48:46 – The changing gap between housing and units

- 54:08 – The Substitution Effect: The Buyers of 2015/16

- 59:11 – Why CoreLogic’s “Women & Property” report matters

And…

- 1:05:09 – What a fantastic session, thank you Eliza!

- 1:07:44 – Lifehack: How to stop feeling overwhelmed when juggling life

- 1:10:52 – WMPN: Greens going to vote against Labor’s Home Deposit Scheme 😮

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android