PLEASE NOTE: We have changed the names of the folks in these case studies.

We’ve all experienced the gut-wrenching anxiety that comes with property investing, and it’s a natural response considering the huge sums of money and extensive time involved.

But what happens when it becomes an overwhelming feeling that wakes you up at 2am?

Folks, this is a REAL story from today’s honest and inspirational Case Study episode.

From Billy, a single dad holding onto his ambition to secure a future for his son amidst personal and financial upheaval, to Liz and Michael, a couple who found themselves constantly fighting their financial fears.

Hear how these investors confronted their anxieties, took that first big step with a qualified accountability partner and created their path to freedom.

The end result? One plan maximises time in the market resulting in a passive income of $2K and the other one creates a net wealth of $17M at retirement😮

Tune in now to find out step-by-step how these folks will achieve this!

P.S. Huge thank you to today’s guests for opening up about their journeys, we know it’ll inspire many folks in the community to take action.

Free Stuff Mentioned

- PICA Webinar: Stage 2 Property Reforms (QLD) with Samara Bedwell, Managing Director at Macwell Property

Wednesday 27th March, 6:30pm- 7:30pm (AEST)/7:30pm-8:30pm AEDT

Become a member to register now! - Moorr: Automate your MoneySMARTS system

Available on Desktop and Mobile, it’s the only app you need to track, trap and manage your money and lifestyle goals. - Previous Episodes Mentioned

- 042 | Investment Strategy, New Developments and Professional Advice – Chat with Steve Waters

- 098 | Unpacking Property Media Headlines – Chat with Jennifer Duke, Property Journalist and Review Editor of Domain

- 478 | What Happens When Money is Used to Control: How She Escaped It & Overcame Scarcity & Gender Wealth Inequality – Chat with Amanda

- AFR Articles from Ben’s “What’s Making Property News”:

Timestamps

- 0:00 – “Stuff This!”: How to Tackle Financial Anxiety

- 2:43 – PICA Webinar: Stage 2 Property Reforms (QLD)

- 3:28 – Social reach out from Kurtis (Share the Ep you’re listening to on your socials!)

- 6:08 – Vale Steve Waters

- 8:46 – Mindset Minute: What is consistency?

- 13:05 – How MoneySMARTS saved this listener!

- 14:33 – Moorr Upgrade Teaser!

- 16:31 – Case Study #1: Billy

- 20:20 – The magic of soundboards

- 22:06 – External Problems: A growing business & limited borrowing capacity

- 23:30 – Mortgage Savvy Brokers vs. Accountants

- 26:59 – The Internal Challenge

- 28:47 – The Plan: How to put more cards on the table

- 31:59 – Contingencies Amanda built into this “Single Gent Plan”

- 38:15 – How Billy is maximising his tax deductibility

- 39:44 – The end goal and his focused transformation

- 43:25 – Case Study #2: Liz and Michael

- 45:46 – The Anxiety Pitch

- 47:43 – Where did the stress and anxiety come from?

- 50:52 – Bryce & Ben’s experience with investing anxiety

- 55:09 – Google Maps Analogy: There is NO one-size-fits-all!

- 57:27 – The Epiphany: “Stuff this!”

- 58:41 – The Plan: The contingency child and education

- 1:03:54 – How this couple took action

- 1:07:25 – $17M at retirement and no more anxiety!

- 1:10:16 – Thank you to Amanda, Stu, Billy and Liz & Michael!

And…

- 1:10:47 – Lifehack: A Bed-Time Routine for Strengthening Connection

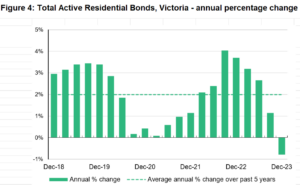

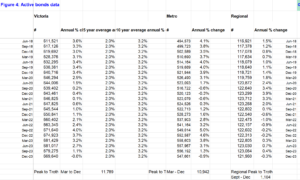

- 1:14:25 – WMPN: Disturbing data from Victoria: House and land sales plummet

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android