With soaring immigration and construction hitting historic lows, Australia’s property market faces an accommodation crisis.

In Bryce’s words, “Disincentives have been happening for over a decade.”

Kicking off our first Q&A session for 2024, we’re diving into the widespread economic and political factors that have become “the perfect recipe” for today’s housing crisis.

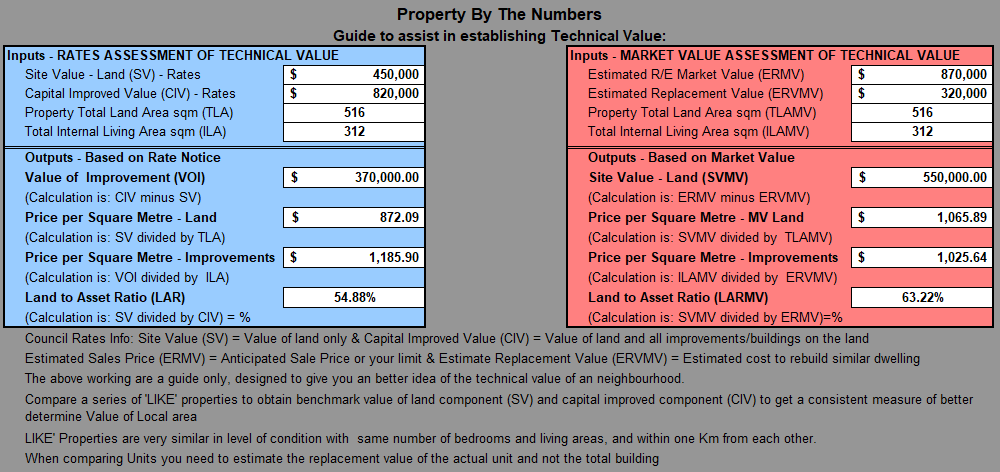

We also dissect how to master the 60% of land-to-asset ratios and tackle this burning question:

Is Brisbane a wise choice for investment with the 2032 Olympics on the horizon? Can we anticipate a property surge post-game?

Tune in now to find out!

P.S. Happy International Women’s Day! To celebrate all the incredible women in our lives, how far we’ve come, and the work still to be done, we’ve got a special message from some of our great friends and past guests on The Property Couch.

Free Stuff Mentioned

- Moorr Webinar: Best Tools for the Job – What to Use When?

7:30pm AEDT, 19 March

Within Moorr, our money management platform, there are currently over 25 features and tools, providing more than 100 different insights! In our webinar we’ll guide you on the best tools for the job and reveal how all your data comes together to give you meaningful insights through our “track your progress” approach to money management. Find out more or reserve your spot >> - Previous Episodes mentioned: 480 | How to FAIL to Retire on $2K Per Week

Graphs mentioned

Questions We Answer

Q1) Investment in Brisbane for 2032 Olympics from Jeremy

“Hey Bryce and Ben, this is Jeremy from Brisbane.

I’ve been listening to you guys now for approximately five months after I discovered your book. I’m up to episode 95 today, plus the one a week that you release.

With this level of immersion, I think I’m actually hearing you guys talk in my dreams. I think I’ve finally got past the foreign language sign ups too, which is a big step.

I really appreciate what you guys are offering with your knowledge and insight based on your experiences and expertise, it’s really helping me personally to make better choices in regards to where I’m coming with my investments.

Anyway, the question is, what do you think about investing in the areas that are being upgraded for the upcoming Olympics in Brisbane?

Do you think they will be good up until then and then crash, or at least decline?

Or you believe that the infrastructure in the area will then support the growth for years to come?

Thanks boys. Appreciate your help and keep up with work”

Q2) Land to Asset Ratio from Bronwyn

“Hi Ben and Bryce, my name is Bronwyn and I just wanted to ask a general question in regards to Land values. We talk about Land to Asset ratios when purchasing property.

I do have a property, and this doesn’t need to be generally specific to that property, but the council valuations or government valuations on the land are far lower than what land is being sold for in the area.

I just wanted to understand when you’re looking at land to asset ratios, which land value were we actually utilizing to get our percentages?”

Q3) Challenges in Addressing the Accommodation Crisis from Michael

“Hi Bryce and Ben, my name is Michael.

I’m interested in your thoughts on the accommodation crisis gripping our country at the moment. We have record levels of immigration while we are recording all time low levels in building approvals and building completions. Builders are going bankrupt every day and leaving the industry.

We have a skills shortage with a lack of trades people available to do the work. Material costs keep rising faster than inflation there’s a shortage of land to develop, increasing interest rates are severely limiting the amount borrowers can obtain from the banks and APRA are still insisting bank apply a 3% test on interest rates charged.

The only solution government seems to be able to come up with is to subsidise build to rent with land tax concessions, and massive investment in public housing. But there are not enough trades to build these dwellings. At the same time, the government punishes property investors with higher taxes, increased compliance costs, expectations of ever increasing standards and accommodation provision, and taxes on short term accommodation.

With private sector provides 97% of private rental accommodation yet I can’t think of one incentive that is being provided to motivate them to provide more. 40% of the build cost goes to three level of government. I feel this needs to be reduced. I would like to see the removal of stamp duty for purchases buying off the plan in order to feed the pipeline for greater supply.

This will provide developers and necessary pre-purchases required to obtain construction funding. The development section has been in decline ever since stamp duty concessions for off the plan purchases were removed several years ago.

I’m interested on your thoughts on this proposal and whether you have any other ideas. Thanks.”

Timestamps

- 0:00 – Cracking the Code: Mastering the 60% Land to Asset Ratio

- 2:47 – Happy International Women’s Day!

- 10:07 – Moorr Webinar: The best tools for the job…

- 12:34 – Mindset Minute: Gold from Poor Charlie’s Almanack

- 21:00 – “The time horizon speak is directly proportional to…”

- 23:47 – Q1) Investment in Brisbane for 2032 Olympics

- 25:35 – What really matters for economic and property growth

- 29:03 – The benefits will actually be spread across Australia…

- 31:12 – Olympic-sized successes and failures

- 35:38 – What happens after the torch?

- 36:03 – Our verdict!

- 37:46 – Q2) Land to Asset Ratio

- 38:48 – How to crack the 60% land-to-asset ratio

- 41:39 – Note! There are different costs for different types of builds

- 42:27 – Hack for properties that are older than 30 years!

- 45:08 – Watch the YouTube video to see this in-depth graph

- 46:28 – Why we prefer older over new properties

- 47:42 – Talk to your local Buyers Agents!

- 48:25 – What happens if you don’t care about land value?

- 50:05 – Q3) Challenges in Addressing the Accommodation Crisis

- 52:13 – Why did the builders tap out?

- 53:27 – The recipe for short-term disaster

- 57:31 – “We’ve Been Disincentivised for Over a Decade”

- 1:02:27 – Victoria’s Minimum Standards are a great example of this!

And…

- 1:03:49 – Lifehack: How to improve your sleep quality

- 1:06:55 – WMPN 1) Fact-checking the Greens

- 1:12:02 – WMPN 2) NSW’s “No-Ground Eviction” up for debate

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android