This episode covers everything a landlord needs to know to PROTECT their investment property!

Sure, “Landlord Protection Insurance” probably doesn’t sound like the most exciting topic in the world… but we can assure you it is a VITAL part of a property investor’s Defence Strategy.

Here’s the deal… Building Insurance is NOT enough if you are NOT going to be the one living in your property… you need to make certain you have Third Party Cover and the necessary protection policies in place that are specific to a landlord’s best interests and needs.

So, here to explain The #1 Checklist For Landlord Insurance is an expert in the field – joining us today is Greg Rowe, CEO of Property Insurance Plus (PIP). Greg has extensive knowledge in ALL things Landlord Protection Insurance – like what to do to cover yourself from Loss of Rent, and loss or damage by tenants to your building and contents… on top of the “regular” cover to safeguard yourself from unforeseen events that could occur to your property.

So, what CAN and CAN’T landlords claim if something goes wrong?

What coverage MUST you have in place from the very beginning?

What is the minimum amount of coverage you should be looking at?

Tune in now to find out, folks!

P.S. To recap all of the gold that’s mentioned in today’s episode, here is PDF Report of Greg’s Top 10 Tips For Landlord Insurance – you’ll also get a deeper dive into what some of the legal terms and claims mean… so every landlord can be adequately protected!

Free Stuff Mentioned…

- FREE Report: 10 Tips Every Landlord Needs To Know To Protect Their Property– Click here to download or simply fill in the form below and we’ll email it to you right away!

- RBA Cash Rate Announcement March 2021: Property Prices Break 17 Year Record!

- Episode 325 | The Step-By-Step Process To Win In A HOT Property Market – Part 1

- Episode 326 | How To Win In A HOT Property Market (Part 2) – The Step-By-Step Process!

- Episode 327 | Winning A HOT Property Market (Part 3) – The Step-By-Step Process!

- Episode 031 (Part 1) | Story of an Investor and Lessons Learnt along the Way – Chat with Carolyn Wright

- Episode 031 (Part 2) | Checklist to Getting A Great Property Manager – Chat with Carolyn Wright

Free resources: 10 Tips for Landlord Insurance

Fill in the form below and we'll email you the PDF right away! 😉

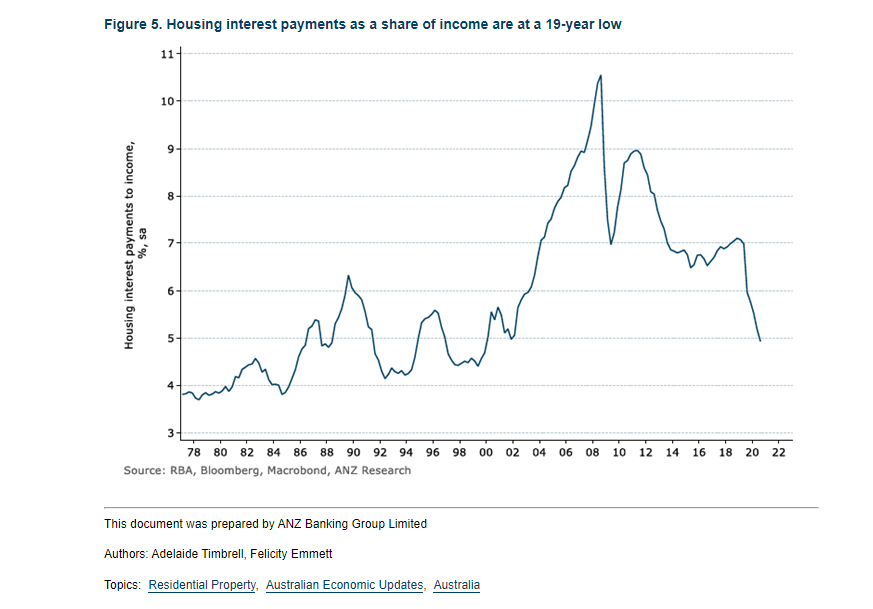

Don’t forget… the affordability chart from Ben’s “What’s Making Property News” segment!

Here’s What We Cover…

- 04:01 – How to criticise and not be hated for it!

- 07:05 – Meet Greg Rowe!

- 07:37 – How did Greg get into Landlord Insurance, anyway?

- 09:22 – What is Landlord Insurance and what does it cover!?!

- 10:01 – What is Building Insurance?

- 10:24 – What will a GOOD Landlord Protection Insurance over you for?

- 10:57 – How many investors get Landlord Insurance?

- 11:55 – What is Public Liability and how much should you be covered for?

- 13:51 – How much should you be covered for Rental Default?

- 15:13 – Do insurers let you choose your policies?

- 16:11 – The Difference between “Rent Default” and “Loss of Rent”

- 16:39 – Bryce’s experience with his recent claim for a burst water pipe…

- 17:30 – The subtle (but significant!) difference between a burst pipe and the resulting damage from a bust pipe

- 18:21 – Why you need your OWN Landlord Insurance even if you’re a part of a Body Corporate!

- 20:00 – How do different insurers treat floating timber floors?

- 20:58 – Understanding policy wording… (get the “jargon explained” here >>)

- 21:10 – What are the different ways insurers treat Bonds?

- 22:19 – How much should you be covered for contents!?!

- 23:27 – Does cabinetry fall under “Building” or contents?

- 22:43 – GREAT Rule of Thumb to work out Building Items vs Contents Items!

- 23:59 – How did insurance policies change during Coronavirus?

- 26:07 – The Armageddon Panic that stripped Rental Default off the table…

- 27:01 – What was the spike in claims during the pandemic?

- 27:54 – How do underwriters work and what are the layers involved behind insurance companies?

- 29:07 – What does “Embargo” mean?

- 31:17 – How many landlord insurers are there?

- 33:14 – The biggest complaint that came through to PICA during the height of the pandemic…

- 34:15 – What was the reason behind “Lower Protection but Higher Premiums”…

- 36:55 – The biggest change in the insurance industry since COVID-19!

- 39:38 – What is the cover for legal costs to evict tenants?

- 40:26 – How great property managers come in…

- 42:05 – Are the certain limitations and premiums for specific postcodes?

- 42:41 – What is THE MOST COMMON Claim?

- 43:00 – What is THE MOST COMMON “Oh, no, we thought we would be covered for that!” claim that is NOT covered?

- 44:42 – How often should you replace the flexi house attached to the toilet?

- 45:58 – Differences in cover for periodic lease agreement (month-to-month) vs fixed term lease agreement

- 48:00 – What is the quickest way to find out what you are covered for?

- 49:00 – Levels of cover for Damage Caused by PETS…

- 50:07 – How much does Property Insurance Plus (PIP) cover for pets?

- 52:45 – Coverage for Death of a Tenant…

- 53:47 – Coverage for SQUATTERS…

- 55:19 – What are the Tenant Hardship clauses…

- 56:40 – The Difference between “Flood Damage” and “Storm Damage”

- 57:16 – When should you get Flood cover?

- 59:46 – Rookie Mistakes for Beginners…

And..

- 1:00:37 – Why is it NOT enough to just get Building Insurance?

- 1:04:07 – How to do your due diligence…

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android