Many investors can’t seem to move beyond owning 2-properties due to limited borrowing power or equity, so why don’t more people turn to Self-Manager Super Funds (SMSFs) as an answer?

Folks, this is just ONE of the enlightening questions from today’s enormous Q&A episode which has a bit of gold for every property investor, no matter what stage you are at on your property journey.

From the ultimate pros and cons list of SMSFs to revealing the true long-term advantages of owner-occupier appeal – and why it matters over high yield – we’re exploring the winning strategies one can use to move up the property ladder.

We also explore the moral and ethical dilemma of property investing (are you evil if you become a property owner?!?) and do a first-time reveal of our newest series.

Tune in now to hear all this – and how you can access this series for free – and learn how to maximise your returns today! 😊

Questions We Answer…

Q1) Property Owners Are Evil from Boyd

Hi Bryce and Ben.

I just want to let you know that I love the podcast. Find it very insightful and I listen to it all the time. My question today is around property investing and, more around the ethical/ moral side.

You hear a lot of the media, even friends and colleagues always scrutinise property investors as – they’re the evil people in the world trying to screw over all the people – which I can agree to an extent I would say.

My partner and I are very ethical and morally driven, we feel like and we are looking to invest next year and struggling to sort of decide whether we actually want to because of those reasons.

We feel we still will because a) we want a better lives and our future, but also b) we don’t think we’re going to be those type of people that will squeeze every bit of money out of everyone and a bunch of other reasons.

I was just more wondering how you would end that sort of question if someone said that to you because….. and if there’s any other. reasons why which would maybe help us in our journey and other people in a journey that are sort of up in the arms about it.

Thank you very much for your time.

Q2) Buying Property Through SMSF from Milind

Hi, I don’t see any dedicated episode on SMSF or buying property through SMSF.

Most buyers get stuck at the second property because of inadequate equity or borrowing power and SMSF is buying property is is really one of the good options but I don’t see anything on that so can you please cover that in detail thank you.

Q3) Why Owner Occupier Appeal from Kate

Hey guys,

Love the podcast but am struggling to see why you would hunt down properties that have owner occupier appeal and good long term capital growth if you also advocate to hold properties for the long term and never sell. 🤷♀️

If you’re never selling them then why does that matter? Wouldn’t you want to find high yielding properties and enjoy cash flow now and in retirement?

Sorry if this is an ignorant question.

Thank you 🙏

Free Stuff Mentioned

- Be part of 2023/24 Summer Series (Especially calling all ladies!). Share your story, get a free Start & Build course and positively impact our community today. Reach out to us here >>

- What’s Making Property News: Read the results from PIPA’s Annual Property Investor Sentiment Survey 2023!

- Previous episodes mentioned:

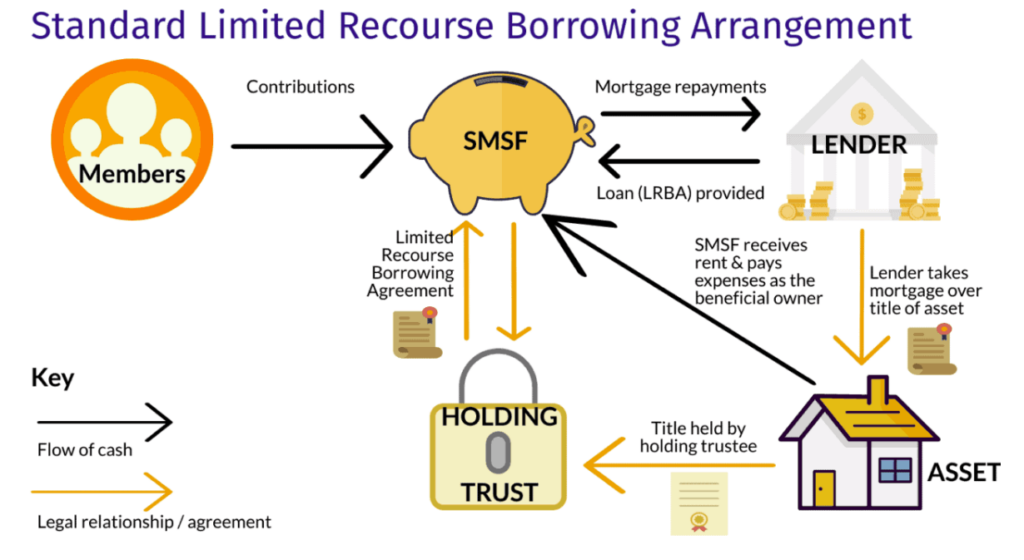

463 | Property Managers: Are They Worth It?! – Q&A Day - Q2) See a helpful diagram of how SMSFs work below.

Here’s some of the gold we cover…

- 0:00 – Using SMSFs to Avoid Getting Stuck on Your Next Property!

- 3:35 – We’ve got a brand-new series out?! (+ How you can get it for FREE!)

- 5:12 – Want to be on the couch?? Calling all 2023/24 Summer Series Guests

- 5:50 – Mindset Minute: The 3 Magic Principles of Mastery

- 8:58 – Q1) Property Owners Are Evil

- 10:32 – A perception shift around providing rental accommodation…

- 14:07 – Why your friends aren’t always right!

- 16:01 – The Fishing Analogy 🐟

- 18:15 – How do we benefit Australia economically and socially?

- 22:42 – Q2) Buying Property Through SMSF (Self-Managed Super Fund)

- 23:24 – A little disclaimer…

- 24:13 – How does SMSF work?

- 26:18 – The Pros of SMSF

- 28:07 – Beware of these Cons!

- 29:39 – Considerations BEFORE using a SMSF

- 33:57 – FOLKS, BE SURE TO GET THIS

- 36:50 – Why does the name of the contract matter?

- 40:25 – Q3) Why Owner Occupier Appeal?

- 41:39 – It boils down to these 2 things…

- 46:06 – The true advantage of owner-occupier appeal

- 50:41 – Justify by emotion & logic!

And…

- 57:39 – Lifehack: Why should you only eat to 80% capacity?

- 1:00:21 – WMPN: The BEST and WORST states to invest in and more findings from PIPA’s 2023 Sentiment Survey

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android