The issue about Property Spruikers is not a new one but a lot of investors out there are still unaware about it and as a result, receiving bad property investment advice. With this in mind, Bryce started this How to Session by defining what is a spruiker and describe some of the common ways to spot one. Here’s a snippet of the video:

I’ve been in this Property Investment industry for over 16 years and I’m often asked this question, “How do you actually spot a Property Spruiker?”. Lots of people talk about property spruikers but what actually is it? In my view, there’s actually three, I guess, people that you can take your information from in this property investment industry. The first person is the Salesperson who is not pretending to be anything other than a salesperson that’s being employed by the developer to sell their product. They sit typically in the sales office, they invite enquiry and they try to sell one of the developer’s product whether it is an off the plan apartment or a house and land package, they are very very clear on what they do. On the other side of the equation, you got the advisor. The true property investment advisor who has no stocklist, no agenda, they want to find out exactly what is going on for the investor so they can work out what tailored solution they need to provide on behalf of the property investor. And then you’ve got this grey area in between.

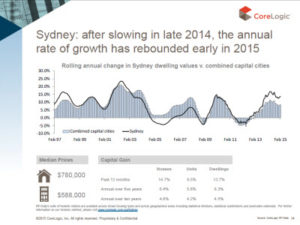

Click here to download the Core Logic report data mentioned in the video: Get access now.

Bryce Holdaway – Partner, Property Advisor & Buyers Agent

Bryce Holdaway – Partner, Property Advisor & Buyers Agent

As co-host of The Property Couch, Bryce Holdaway is also a partner at Empower Wealth and Co-Host of Relocation Relocation Australia and Location Location Location Australia on Foxtel’s Lifestyle Channel. A qualified Buyers Agent and Financial Planner, Bryce holds a Bachelor of Commerce (Accounting), Real Estate Agent License and Diploma in Financial Services (Financial Planning).

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android