It’s no surprise that Ben and Bryce are huge advocates of property investing but until now, they haven’t explained WHY they love it so much! 🏘︎

Today we’re taking a walk down memory lane and discussing why and how Ben and Bryce first got into the residential property market and why they’ve continued to stay!

From Ben’s early love of investing to Bryce’s captivation with Jan Somers’ back of napkin calculations, we’ll also hear about Ben’s “apprenticeship” years that’s made him the guru he is today!!

PLUS we’ll be looking at the fundamentals you should know about investing (Including how property can be BOTH a liquid and non-liquid asset, we know it’s a bit of a head-scratcher…

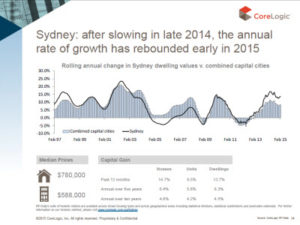

And applying those to Sydney and Melbourne markets today.

We’re sayin’ that this time – the rising time will NOT lift all ships!

In this podcast, Bryce and Ben also mention that based on CoreLogic’s “Pain and Gain” Report, properties held for shorter time periods are much more susceptible to loss. To read the full report, click the image to the right.

Listen in now!

Free Stuff Mentioned:

- Just starting your property investing journey? Check out our FREE Binge Guide to the Foundations of Property, Finance and Money Management, which shows you which episodes you need to understand the basics! Or fill in the form below and we’ll email it to you right away!

- CoreLogics “Pain and Gain” report. For more information on CoreLogic visit RP Data CoreLogic

Here’s some of the gold we cover…

- 0:30 – Ben’s been through the wars…

- 2:12 – Why Ben first got into property investing!

- 5:20 – Why Bryce first got into property investing!

- 6:55 – A bit of gold from Robert Kiyosaki

- 7:45 – What does property investing mean for YOU?

- 9:00 – Ben’s “apprenticeship” years

- 10:05 – Sydney and Melbourne folk – beware of the market now!

- 11:20 – Case Study: Manly (and what you should learn from it!)

- 14:41 – Why the rising tide will NOT lift all ships

- 15:30 – THIS is what you need to understand about property investing….

- 16:15 – Different investing strategies!

- 16:58 – The independent umpire is….

- 18:10 – Why property is both an illiquid AND liquid investment!

- 20:00 – We’re at 4.5k downloads – THANK YOU folks!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android