When investing in property, choosing WHERE to invest often keeps folks up at night. That’s why, in today’s Q&A Day, we are answering questions that speak to this very issue.

Here’s what we’re unpacking:

Why choose to invest regional over city? (Tune in to 1:02:10 to hear Ben poise a riddle to the community. Oh, and send us your replies through our SpeakPipe! 😉)

From the multi-layered factors to consider BEFORE buying in the country to whether Gary (today’s question asker) has made the right decision to invest in Ballarat, we’re uncovering the one question that investing regional boils down to.

Plus, we answer what elements make a town a mining town, the biggest risks associated with investing in these “boom and bust” areas, and our case for why we avoid investing in Canberra!

It’s an episode loaded with nuggets of wisdom, tune in now folks! 😊

P.S. As market conditions change, we’ve been noticing some concerning ads popping up, which is why we’re sitting down to unpack: What does modern-day spruiking look like?

Free Stuff Mentioned

- Leave us a Q for our next Q&A Day! Reach out to Bryce on Instagram or through our SpeakPipe. (And get a free Start & Build course if your Q is featured!)

- Free Money Management Platform: Moorr

- Episodes Mentioned:

- TPC Binge Guide (First 20 Episodes of our most fundamental lessons!)

- 256 | From Gold Mine To Fool’s Gold: How This Property Investor Nearly Lost It All During The WA Mining Boom! – Chat with Rick Hockey

- 418 | The Hidden Forces Driving Property Values

- 474 | From Childhood Stocks to City Shocks: How He Escaped Bad Investing Advice! – Chat with Bailey

- 484 | Cracking the Code: Mastering the 60% Land to Asset Ratio

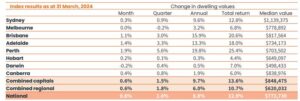

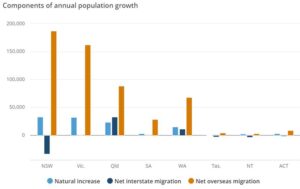

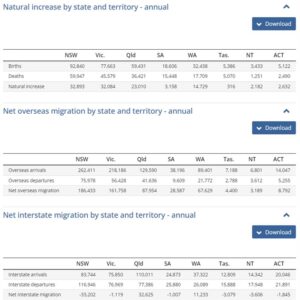

- Graphs from Ben’s “What’s Making Property News”:

Questions We Answer…

Q1) Investment Property in Canberra from Jenna

“Love the show. I have listened to every episode. A bit of a fan. I’ve done your property plan through EW. I have used to mortgage broking services, your BA services and your accounting services.

Thank you for all the information and services that you provide.

I have two questions today and it is specifically related to my situation, but I think a few of your listeners we’ll have similar questions.

To begin with the background, my partner and I had our PPOR currently sitting at around 490,000 on our mortgage remaining 300,000 in equity. That 490 includes a $100,000 equity release, which we used to buy and investment property in the South Brisbane.

My biggest question is based around the fact that our PPOR is located in Canberra. I’ve listened to you guys for several years and specifically on your more recent podcasts.

You reiterate that you despise having an investment property in Canberra.

Our PPOR is not our forever home, but we would be happy here for another four or five years. Our original plan was to transition our PPOR into an IP and I guess my question is, would you still recommend this?

For more context, our mortgage is currently about $2,400 a month and being very concerned if we could get up to $2,500 even $3,500 a month in rent understanding that there’s a complication for land tax.

My question is what would you do with this house sell? or turn it into investment property?

My second question as I believe I know what your answer will be to the first question is what happens to the equity release against our current PPOR if we sell?

Will we need to pay this off? Or can we leave it as is as the interest is tax deductible?

Thanks guys. Love your work.”

Q2) What is considered a mining town? from Jenny

“Hi Ben and Bryce, Jenny here.

Thank you for the invaluable content over the years. Without the education provided in your poddies, we would never have embarked on our property investment journey.

I have a few questions regarding mining towns, which I believe the Community can benefit from.

We do not invest in mining towns as two wise men have informed us over the years, but which towns are considered mining towns and how do you work this out?

Is it just the suburb where the mining actually takes place? Or does it extend to surrounding suburbs

Would you look to ABS data to see the percentage level of residents who are employed in the mining industry?

And if so, would say anything over 5% of the population working in the mining sector, then make that Suburb a mining town. The wisdom on this will be greatly appreciated.

Thanks boys.”

Q3) Regional Properties from Gary

“Hi Bryce and Ben,

My name is Gary I live in Spotswood, West of Melbourne. I’ve just got a question I’d like to ask you about regional properties.

Two years ago, I went through our financial planner and bought his agent and got a three-bedroom house in Ballarat North just outside Melbourne. And my question was that there’s been a lot of talk regarding regional properties versus sort of properties near the CBD.

Now, I just wanted to get your thoughts on what you class as a good regional property because especially in Victoria, we have regional areas such as Geelong, Ballarat, and Bendigo a bit and they’re not exactly what I call small, they have a lot of amenities, a lot of industry, and job creation out there.

But I just find that when you read information quite vague about regional properties, they say they don’t do as well as in the city and they obviously at the moment they’re not increased as much as they’re near the inner city.

But I’m just interested to see your thoughts and maybe have a bit of a deeper look or a deeper dive into the regional market as we like.

I think we’d like to focus on the inner cities and central CBD’s in Melbourne and Sydney.

It’ll be good to hear your thoughts on that.

Thank you.”

Timestamps

- 0:00 – Buying Regional vs. City: Does It Stack Up?

- 1:43 – Ben’s stopped sweating 😉

- 3:12 – Warning: THIS is what Modern Day Spruiking looks like

- 7:04 – Where modern spruiking happens & why it’s so successful 🙁

- 10:18 – What kind of investor are you?

- 15:27 – From the Coalface: 8 of 12 tenants moving because landlords are selling up

- 18:25 – Mindset Minute: “There is never anything to do, but always action to take.”

- 22:36 – As a property investor, what practical action can you take?

- 24:13 – Q1) Investment Property in Canberra

- 26:29 – Hold or move into another market?

- 30:50 – The science behind NOT investing in Canberra

- 34:25 – Beware of regulatory risks: How holding costs are disincentivising investors

- 37:41 – If you’ve built a portfolio in Canberra, let us know how you’ve done it!

- 38:36 – How is my loan transferred if I sell the property?

- 40:55 – The Stand-Alone Scenario

- 45:42 – Q2) What is considered a mining town?

- 46:43 – The risk with mining towns

- 51:10 – Is Perth a mining town?

- 53:04 – Why Perth is heading towards a golden era

- 58:10 – Q3) Regional Properties

- 59:40 – Not all regional properties are created equal

- 1:00:57 – We need to acknowledge this for the next generation of investors

- 1:02:10 – “Will regional land grow higher than the city?”

- 1:06:34 – Ben and Bryce have both bought regional!

- 1:09:45 – Historically, regional has been great for yield

- 1:10:29 – It comes down to the M___ of S____

- 1:12:48 – Consider these factors when buying regional!

And…

- 1:17:14 – Lifehack: Make Decisions like Jeff Bezos

- 1:22:53 – WMPN: House Price Movements across Australia

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android