Have you heard about the myth that all property double in value every 7 – 10 years? If this is true, it is certainly an irresistible offer! But if it is true, why isn’t everybody investing in property? Unfortunately, based on the report recently released by Core Logic (download link below), this is simply not true. In fact, only three capital cities in Australia had doubled their median house prices in the last ten years and so, for today’s episode, Bryce and Ben will be doing a bit of myth busting.

They will also be answering a question from Stacey:

Hi Ben & Bryce,

I have a question about the suburb of Cranbourne in Melbourne…

I recently went to a property seminar in Melbourne and the presenter was telling us that Cranbourne will be a big growth area in the future, along with Pakenham, Officer and another suburb I cannot recall. Do you think this is true? Only because my partner has a house in Cranbourne he has invested in and is renting out at the moment, and we are not sure whether to hold onto it or not.

Many thanks guys and I am loving your podcasts.

Free resources mentioned in this podcast:

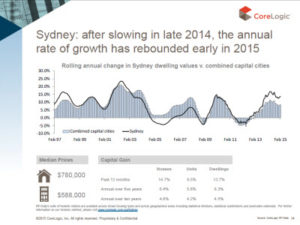

- How many suburbs have seen median prices double over the past decade? By CoreLogic, October 2016 – Read here

- FREE Tickets to the Sydney Property Buyer Expo (Coupon code: PBE16BRYHOL) – Get them here

- Salvation Army Moneycare Day – Learn more here

If you like this podcast: “Does All Property Double In Value?”, don’t forget to rate us on our iTunes channel (The Property Couch Podcast) and our Facebook page. If you have any questions or ideas, feel free to drop us your thoughts here: http://tpcaustralia.wpengine.com/topics/

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android