Back by popular demand! We heard from today’s guest back on Episode 107, and joining us again is none other than Nicole Faid, Principal and Founder of Accord Conveyancing, who has handed out accurate legal advice for over 25 years of industry experience! Just a heads up — we covered her awesome back story in that episode, so if you want to hear it (and it’s well worth the listen), go back and check it out!

So — Conveyancing — let’s take the mystery out of it, folks! Because a lot of people out there don’t know what happens once the documents have been handed over to a Conveyancer, especially one like Nicole!

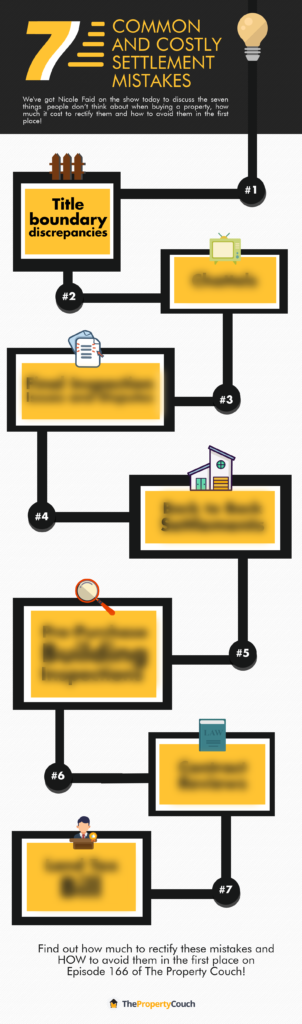

And we jump straight into it, folks! So get pumped for the 7 common & COSTLY mistakes you really DON’T want to make…

(If this episode doesn’t cement the fact that it’s crucial to get a contract review BEFORE you sign, very little will!)

So, let’s hear it. What exactly are you in for?

- In a nutshell, what does a conveyancer do?

- What is the most important document that underpins a contract?

- How many people don’t get the amount of land they thought they would when purchasing a property?

- What happens if the discrepancy of this land is less than 5%?

- What REAL LIFE EXAMPLE happened in Brunswick? (And how much did this mistake cost the buyer?!)

- Why shouldn’t you rely on your own interpretation of “wear and tear”?

- Are “back to back settlements” a bad idea?

- What happens with the conveyancing rules if you’re a borderless investor?

- What is a “caveat”?

- If you’re purchasing through a SMSF, what title requirements do you need to be aware of?

- What can happen in the settlement period that will seriously shock you?

- Why is it important to distinguish between major and minor issues with the settlement process?

- When should you conduct a Building and Pest Inspection?

- How does the art of negotiation fit into all this?

- What is the best risk management?

- What do you need to keep in mind with the final inspection?

- What is the legal requirement about having a granny flat?!

… Yep, it’s a hairy and very serious episode folks, because the mistakes we talk about in this episode can be VERY EXPENSIVE!!

TODAY’S TEASER:

P.S Missed yesterday’s Facebook Live?

We answered a couple of questions on your lunchbreak (in 15 minutes)!

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android